Ethiopia is one of the ancient global civilizations that had its own currency, which at the time were coins. In different occasions and periods the coins had been changed and at times non Ethiopian coins like the Maria Theresa thaler, the silver bullion coin, commonly referred to as the mint of Austria were used.

At about 1903, as modernization hit, the new Ethiopian coinage appeared.

The thaler became the standard unit on 9th February 1893 and 200,000 dollars were produced at the Paris Mint in 1894 for Emperor Menelik II.

In the contemporary history of Ethiopia the first banknotes or paper money were rolled out in 1915 by the Bank of Abyssinia.

The Bank of Abyssinia introduced banknotes having denominations of 5, 10, 100 and 500 talari, and 280,000 talari worth of notes was printed at the time.

A 50- talari note was added to the mix in 1929. At that time over 1.5 million talari in notes were already circulating in the market.

History indicated that though the paper money had been minted in the early 20th century, it was received with difficulty of acceptance by the public. The general public preferred to use the picture button coins of Emperor Menelik II and Maria Theresa thaler and the traditional bar of salt (amole).

Throughout time when the banknotes have been in use it remained without feature changes until 1945. According to Yinager Dessie, Governor of National Bank of Ethiopia (NBE), until 1945 different foreign currencies had been in use in the country and these include; the British East African shilling and history also states that after the Italian occupation lira had been in circulation.

The Emperor Haile Selassie Banknotes

In 1945, four years after Ethiopia became free from Italian invasion, Emperor Haile Selassie came up with a new decree that enforced the use of the new Ethiopian banknotes with the feature of the Emperor and in denominations of 1, 5, 10, 50, 100 and 500 birr. In process the 500 birr faced suspension and was phased out.

The Emperor Haile Selassie’s banknotes’ was introduced on the 23rd of July 1945 and continued circulating until 1976 with minor changes in its feature. Yinager further stated that the Emperor Haile Selassie banknotes were the currency that was effective for long period of time.

The DERG currency

On September 1976, the notes issued by the DERG fully changed the features of the emperor notes. The notes mainly reflected the socialist political ideology that the DERG administered. The DERG currency remained in use till 1997 despite the regime being removed from power in 1991.

In November 1997, EPRDF, the government that was in control changed the DERG currency by issuing minor features and colour changes. The higher denominations, that is, 50 and 100 birr received improved security features.

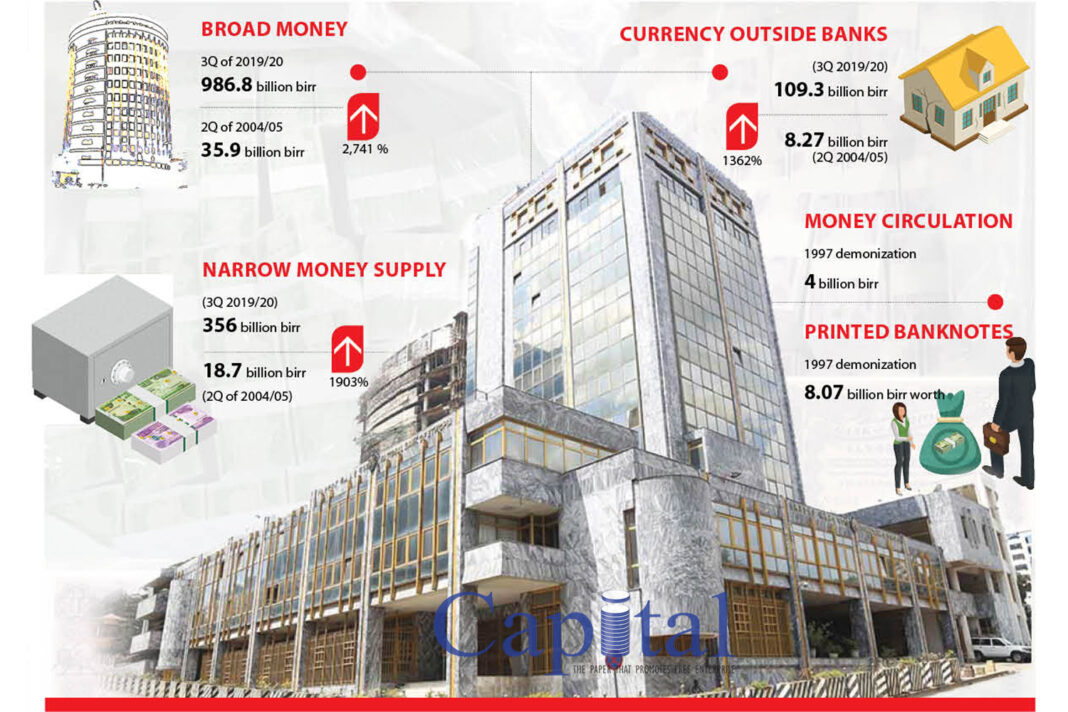

Information that Capital obtained from NBE shows that the money circulating in 1997 in the market was an estimated 4 billion birr. The central bank printed 8.07 billion birr worth of notes on the replacement of the currency at the time.

The fifth fresh face currency

Early this week the government of Ethiopia introduced new currency notes, with enhanced security features and other distinctive elements. The new currency notes replaced the 10, 50 and 100 bill notes while an additional 200 birr note was introduced.

The new currencies are totally different in features from what was being used 44 years back.

The notes are reflective of the natural, historical features of the country besides anticipating the future strategies like industrialization and modern agriculture.

NBE said that the 5 birr note will remain unchanged and will be turned into a coin format soon. The 5 birr note will no-longer be printed and that it will be converted to coin format soon.

Yinager told Capital that the government has been in operation for the past ten months to change the currency but the project was faced with significant delay because of COVID 19.

In the meeting held at the Office of the Prime Minister on Monday September 14 the Governor said that the printing process faced setbacks as the workers were unable to go to the printing house because of the virus.

“We had planned to introduce the new notes about three months ago, but the outbreak forced us to reschedule the plan,” Yinager told Capital.

The government disclosed that 2.9 billion notes with the value of 262 billion birr have been printed. For printing the money the government paid 3.7 billion birr which on average means 1.275 birr per note.

When the country changed the currency in 1976 it costs 18 million birr which is 205 times lower than the current cost.

Yinager stated that the average of 1.275 birr per note was not reflective of the separate individual denominations. For instance the print cost for 200 birr note is not similar to the 10 birr note. The 200 birr security features included the latest technology like spark that is used in other big currencies in the world that consequently costs the government much more.

“For the biggest denomination, 200 birr, we decided to preserve it from forgery thus we scaled up its security features,” the Governor said.

According to Prime Minister Abiy Ahmed, the volume of notes printed is very high. He said that the 10 birr notes printed for the current change is much higher than the total notes printed in the 1997 currency change. This is an indicator of how much huge money has been circulating in the market.

Prime Minister Abiy has ordered the implementation of tight security on borders and Bole International Airport to control the money that may be smuggled to and from the country. The command post accountable for the success of this endeavor includes the National Defense, National Intelligence and Security Service and Federal Police.

According to the plan, those who have more than 100,000 birr should change their currency within a month’s time and those who have 10,000 birr should save their money in banks. Banks however insist that individuals who have 5,000 birr should open a bank account to save their money.

Yinager said that the currency change was mainly motivated by economic reasons, that is, to return the cash that is out of the bank system back to the bank. Furthermore the move seeks to counter the contraband and corruption issues thus helping to support financial institutions confront currency shortage.

The Bankers Commentary

Recently, the Bankers Association disclosed that since it has been over half a decade the currency change was a requirement needed to reduce the cash amount that was out of the banking system.

The association president welcomed the government’s decision since it has massive result to the sector and the overall country’s economy.

Abe Sano, president of Commercial Bank of Ethiopia and current head of Bankers Association, stated that in order to meet the anticipated target the period should be reduced to one month from the three months of currency change time.

He added that the time frame that is given for those who hold more than 100,000 birr should reduce to 15 days. He further emphasized that those who are supposed to open bank accounts should start savings from 5,000 birr from the proposed 10,000 birr.

“In the previous notes change that was conducted 23 years ago the number of bank branches was very small which is not the case now, therefore an extended period may not be needed on the changing process,” Abe said.

According to NBE’s quarterly bulletin that shows the overall economy from January to March of 2020 the total bank branches in the country had reached a total of 6,362 of which 70 percent of them are private banks.

Consequently, one branch on average serves 15,848.6 1 people.

For the comments made by the Bankers Association, Abe stated that the timeframe was one of the debated issues by the group who conducted the project. The project was known as project X and was secretly conducted by very few individuals.

“If we give an extended period for this procedure, the process shall put extra pressure on the banks. If you have conducted the operation within the few stated periods it may be restructured based on the discussion with NBE and banks,” Abe explained.

The latest economic bulletin of NBE indicated that in March the broad money supply (M2) stood at 986.8 billion birr showing an 18.6 percent growth over the corresponding quarter of last year. The broad money expansion has expanded by close to 28 times or 2,741 percent in the last 15 years.

The NBE document indicated that at the end of third quarter of 2019/20 fiscal year, quasi-money supply depicted 14.9 percent annual expansion and 1.9 percent quarterly increase. Narrow money supply surged 25.7 percent on annual and 7.3 percent on quarterly basis. Narrow money contributed 47.0 percent and quasi money 53.0 percent to the annual M2 growth.

From the narrow money supply that stood at 356 billion birr the currency outside banks is 109.3 billion and the balance is on demand deposit. The currency out of banks has significantly climbed like M2 in the past couple decades.

For instance at the close of the second quarter of 2004/05 fiscal year, which is 15 years ago of the last fiscal year, the broad money supply was 35.9 billion birr, while the currency outside banks was 8.27 billion birr. This is a significant increase of 13 folds approximately 1362%.