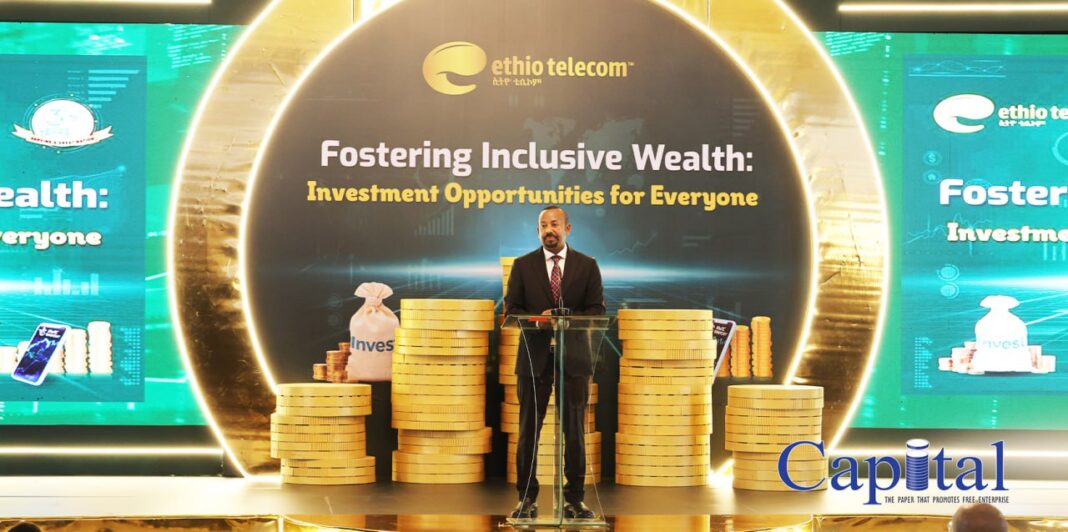

Ethiopia has officially launched the sale of a 10% ownership stake in Ethio Telecom, the country’s leading telecommunications provider, as part of a broader initiative to engage citizens in the telecom sector. Prime Minister Abiy Ahmed announced the commencement of this sale, marking a significant transition for Ethio Telecom, which has evolved from a state-owned development company to a shareholding entity.

The Prime Minister highlighted that the government aims to increase the share available to Ethiopians in the future, building on an earlier decision that allocated 40% of shares to foreign investors, 10% to local citizens, and retained 50% for the government. “The 10% stake given to Ethiopians could grow,” he indicated, reflecting optimism about expanding local ownership.

The shares are being offered at an estimated price of 300 birr each, with a minimum purchase requirement set at 33 shares, totaling approximately 9,990 birr. The government has emphasized that this initiative is part of Ethiopia’s first capital market sale and is designed to enhance public participation in the telecom sector.

Frehiwot Tamiru, CEO of Ethio Telecom, explained that buyers can purchase up to 3,333 shares, amounting to a maximum investment of about 999,900 birr. She also noted that each share purchase will incur taxes and service fees.

The transition to a shareholding company was formalized on June 21, 2024, under the Ethiopian Commercial Code. This change is expected to improve Ethio Telecom’s operational efficiency and expand access to capital while enhancing service quality for customers.

By allowing Ethiopian citizens to own a stake in their largest telecom and digital financial services provider, the government hopes to foster greater engagement and investment in the sector. The move is anticipated to play a crucial role in further developing Ethiopia’s economy and increasing access to essential services.

In this initial round of sales, Ethio Telecom is offering 300 million ordinary shares valued at 100 birr each. Interested buyers must comply with requirements set by the Ethiopian Capital Market Authority as part of the public offering process.

With an estimated capital of 100 billion birr and a net worth of approximately 300 billion birr according to global market evaluations, Ethio Telecom’s transformation into a shareholding company marks a new chapter in Ethiopia’s economic landscape.