For decades, the Washington Consensus has been heralded by the IMF and the World Bank as the magic formula for economic growth. These international financial institutions insisted that a blend of fiscal discipline, trade liberalization, and privatization would lead countries—particularly in the Global South—on the path to prosperity. Yet, after decades of these policies being imposed, the question lingers: Did they deliver what was promised, or did they sabotage the very economies they aimed to save?

The Washington Consensus, coined in 1989 by economist John Williamson, outlines a ten-point policy list that has since dominated global economic policymaking. But there’s a glaring problem: it hasn’t worked. Economist Ha-Joon Chang from Cambridge University points out that no country in history has ever industrialized and developed using pure free-market policies of the kind advocated by the Washington Consensus. In fact, the world’s leading economies—the UK, USA, Germany, Japan—all thrived by doing the exact opposite. These countries used protectionist policies, guiding state intervention, and subsidies to nurture their infant industries until they were strong enough to compete globally.

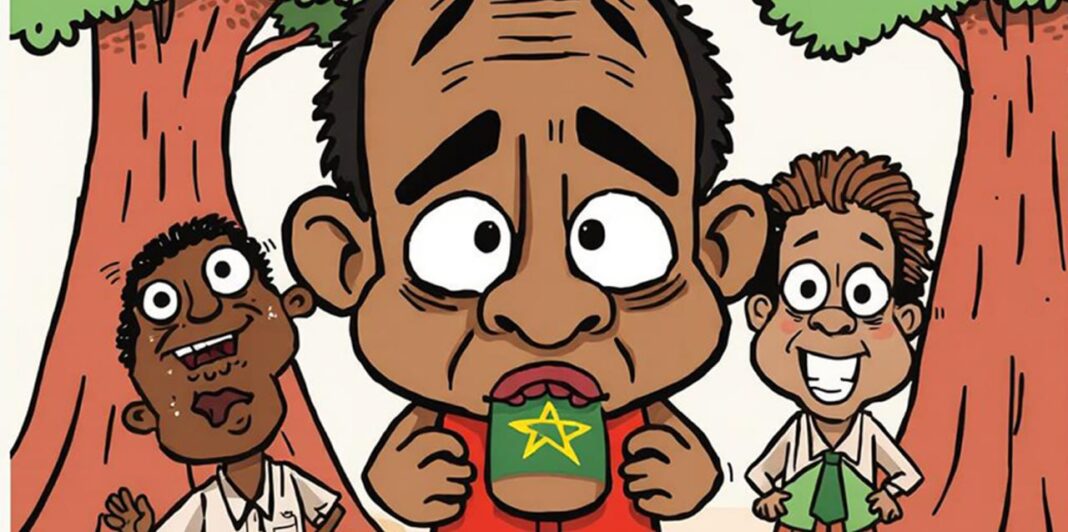

Compare that to the advice given to the Global South: throw open your doors, eliminate tariffs, and let the market work its magic. Spoiler alert: the magic never came. Instead, countries like Ethiopia, Ghana, and Zambia found themselves stripped of their ability to protect local industries, left vulnerable to deindustrialization, and turned into suppliers of raw materials for wealthier nations.

Let’s unpack some of these policies. The Washington Consensus encouraged cutting government spending on essential services like education, healthcare, and social welfare—arguing instead that the money should be spent on areas with “higher economic returns,” like infrastructure. A classic case of penny-wise, pound-foolish. While shiny roads may look good, an uneducated, unhealthy workforce doesn’t drive economic growth.

And then there’s the directive to liberalize the financial sector and remove restrictions on foreign direct investment (FDI). Sounds progressive, right? Except that this often allows wealthy multinational corporations to sweep in, gobbling up local businesses and wiping out competition, while the local economy is left gasping for air. The competition isn’t just unfair—it’s annihilation by the big boys.

Meanwhile, trade liberalization and deregulation are sold as the gateway to prosperity. In reality, they function more like a bulldozer, flattening any domestic industry that dared dream of competing with global giants. With local industries gone, many countries in the Global South are left dependent on exporting raw agricultural products back to the same countries that profited from their deindustrialization.

Perhaps one of the most damaging pillars of the Washington Consensus is privatization. On the surface, it sounds logical—let private companies run formerly state-owned enterprises more efficiently. But the reality is far more sinister, especially in the Global South. Privatization often means selling off valuable public assets to foreign corporations, turning critical national industries—such as utilities, telecom, transport, and banking – into profit-driven machines.

The consequences? The public ends up paying the price, quite literally. Telecom services become unaffordable, electricity access dwindles, and banking becomes a privilege for the wealthy. In many other countries, privatization has created monopolies where foreign corporations dominate key sectors, raising prices and slashing local jobs. Instead of fostering competition, it destroys it, leaving citizens vulnerable to exploitation.

Take the example of Zambia’s copper mines. Once privatized, foreign investors took control, reaping huge profits while the Zambian government saw little of the revenue and local workers faced layoffs. Privatization often resembles selling the family silver to foreign bidders, leaving the national economy impoverished and disempowered.

Ah yes, and then there’s debt. The very institutions pushing these neoliberal policies are the same ones loaning money to these countries. But how can a nation shrink its economy through austerity measures and still expect to pay back its ballooning debt? The math doesn’t add up. In fact, many of these policies have worsened debt-to-GDP ratios, leaving countries in a perpetual cycle of borrowing and austerity—like trying to get out of a hole by digging deeper.

In a stunning twist of irony, even the IMF—the loudest advocate of neoliberalism—admitted in a 2016 report, “Neoliberalism Oversold,” that some of these policies increased inequality, which in turn jeopardized sustainable growth. You read that right: after decades of telling the world to tighten their belts and let the market lead, the IMF itself confessed that the formula might not be as foolproof as they thought.

So, is neoliberalism finally on its way out? Signs of a shift are already appearing. In the UK, a traditionally free-market government has nationalized a steelmaker and threatened to enforce fan ownership of football clubs—both moves that reflect a turn back toward state intervention. Elsewhere, countries are reconsidering their blind faith in free-market policies and exploring more assertive roles for the state in their economies.

The lesson? The road to development isn’t paved with free markets alone. In fact, the most successful economies have always used a blend of market forces and government intervention. If the Global South is to rise, it’s high time to abandon the “one-size-fits-all” policies of the Washington Consensus and instead embrace a model that allows countries to protect their industries, guide investment, and nurture growth from within.

As the saying goes: “Fool me once, shame on you. Fool me twice, shame on me.” The Global South has been fooled long enough.