Banks are being urged to align their foreign exchange rates with the parallel market to foster a functional market economy and strengthen economic reforms. However, challenges such as governance issues and taxation are becoming more prominent in the economic landscape, overshadowing the forex concerns.

In July 2024, the Ethiopian government initiated bold macroeconomic reforms aimed at revitalizing the economy, including the liberalization of the foreign exchange (FX) market.

This move was designed to address chronic foreign currency shortages and stimulate market competition. However, experts monitoring the reforms note that banks’ cautious approach to maintaining their valuations has hindered progress.

Tewodros Makonnen, Senior Country Economist for Ethiopia at the International Growth Centre (IGC), remarked that it may be premature to fully evaluate the reforms’ impact on other economic areas, such as the growth of the export sector.

He did highlight, however, that goods previously traded illegally are now entering the formal market, which is boosting export revenues.

“To truly gauge the reform’s success, new export products must be introduced,” Tewodros stated. “While nine months is sufficient to evaluate the FX market,” he explained that although the FX market has been opened, it is not yet operating efficiently. Banks, worried about declining forex assets, have been reluctant to engage actively. When the reforms commenced, banks faced significant foreign exchange liabilities, and the shift to a market-based exchange rate further widened their losses in local currency terms, exacerbating their hesitance.

While the gap between the official and black-market rates has narrowed from over 100% to around 8%, Tewodros argued that the rates should be nearly identical. “Other countries’ market experiences differ from Ethiopia’s current situation,” he noted. Although tight fiscal and monetary policies have stabilized the market, further convergence between official and parallel rates is necessary.

He criticized private banks for mirroring the Commercial Bank of Ethiopia (CBE) rather than responding to market dynamics. “CBE’s rates remain stagnant and significantly below black-market levels,” he said, emphasizing that banks should adjust their rates to align with the parallel market.

Currently, many banks impose service charges exceeding 10% on forex transactions to offset losses. While banks primarily earn from interest rather than FX dealings, these heightened fees reflect efforts to compensate for diminished assets.

Tewodros recommended that banks absorb short-term losses by narrowing the gap with the parallel market. “With remittances and export revenues flowing in, banks can rebuild their forex assets over time,” he stated. He also suggested that banks slow their forex sales to strengthen their balance sheets. “If banks take these steps, they can transition smoothly into a more stable market environment.”

“Banks play a crucial role in signaling market activity, and without their full participation, the reforms may not yield the desired results,” Tewodros, who has also contributed to the reform process, opined.

Initially, the reforms focused on alleviating severe forex shortages, but emerging challenges—such as corruption, tax disputes, and inefficiencies in public services—now require attention.

The government, facing reduced direct advances, is advocating for higher tax collection. While macroeconomic reforms aim to overhaul legislation, issues like tax administration, corruption, and public service delivery will take time to resolve.

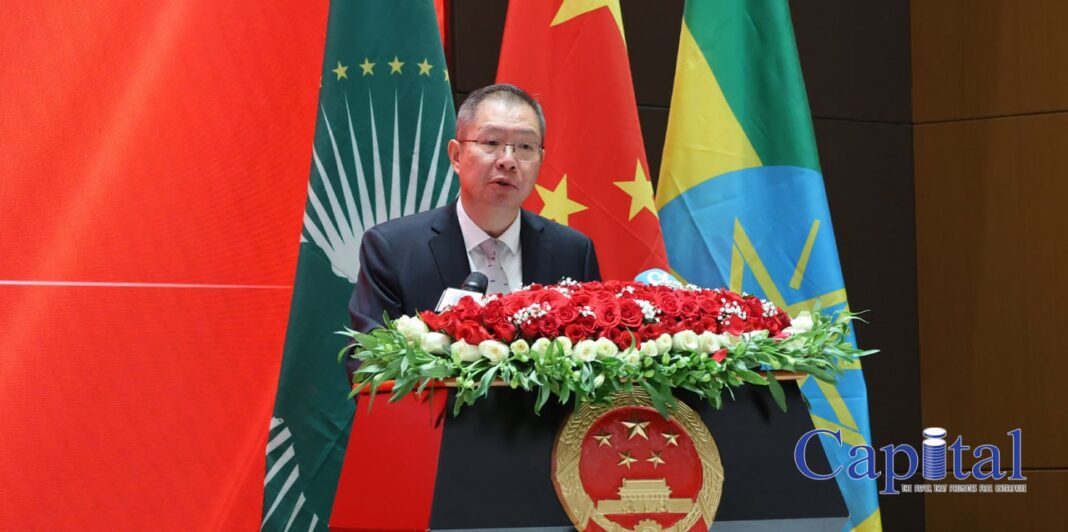

In an exclusive interview with Capital, Tewodros emphasized, “Broader institutional reforms are essential to sustain long-term economic transformation.”

The IGC, a collaborative initiative established by the London School of Economics and the University of Oxford, has been actively contributing policy recommendations to support Ethiopia’s macroeconomic reforms.