Investor demand for Ethiopian Treasury bills (T-bills) soared to 159% of the amount offered, a surge the Ministry of Finance (MoF) attributes to improved primary market conditions following the introduction of a three-month T-bill issuance calendar.

At the start of the budget year, the MoF published its inaugural three-month T-bill issuance calendar. According to the Ministry’s first domestic debt bulletin, issued this week, “The issuance calendar offers market participants improved transparency into upcoming auctions, enabling better planning and fostering investor confidence.”

Since its introduction, market participation and subscription rates have markedly improved across all T-bill tenors. During the first two months of the 2025/26 fiscal year (July and August), the government raised 111.1 billion birr through four T-bill auctions, exceeding its planned issuance of 103.4 billion birr.

Investor demand was exceptionally strong, with total bids reaching 164.7 billion birr. This represents 159% of the amount offered and resulted in an average subscription rate of 107%.

“This performance reflects both deepening market participation and the effectiveness of recent reforms to improve transparency and predictability in domestic debt issuance,” the Ministry stated.

The auction outcomes revealed important shifts in investor behavior. Initially, demand was concentrated on shorter-term 28-day and 91-day bills, while longer-term 182-day and 364-day bills saw subdued interest.

In early August, the subscription ratio for the 364-day tenor fell to a low of 20%, underscoring weak demand.

This period also saw a yield curve inversion, where 182-day bills offered higher yields than 364-day bills.

From a financing perspective, the gross issuance of 111.1 billion birr was used primarily to refinance 78.2 billion birr in maturing T-bills and to roll over another 9 billion birr. This resulted in a net issuance of 23.9 billion birr.

By the end of August 2025, cumulative net issuance represented 14% of the annual target of 172.9 billion birr.

“Overall, developments in July–August 2025 highlight the positive impact of the government’s active management of the T-bill market,” the MoF concluded.

This bulletin is the government’s first significant debt analysis published in nearly a year, following a report on the first quarter of the 2024/25 fiscal year.

A separate MoF debt report from the Debt Management Division, dated June 30, 2025, placed Ethiopia’s total public sector domestic debt stock at 2.5 trillion birr. Long-term Treasury bonds (T-bonds) accounted for the largest share at 80%, while medium-term treasury bonds and T-bills represented 8% and 10%, respectively.

It is worth recalling that since the end of 2022, the government had imposed a mandatory purchase requirement of 20% in T-bonds on commercial banks for every loan disbursement.

This policy was discontinued as of July 2025. As of the end of August 2025, the 364-day T-bill remained the largest component of outstanding T-bills, accounting for 39% of the total stock.

The Ministry’s reforms are showing positive results. By addressing pricing distortions and enhancing transparency, the new measures have helped improve average yields and subscription patterns, and are beginning to shift investor demand toward longer-term maturities.

These are critical steps for reducing rollover risks and supporting the development of the domestic debt market.

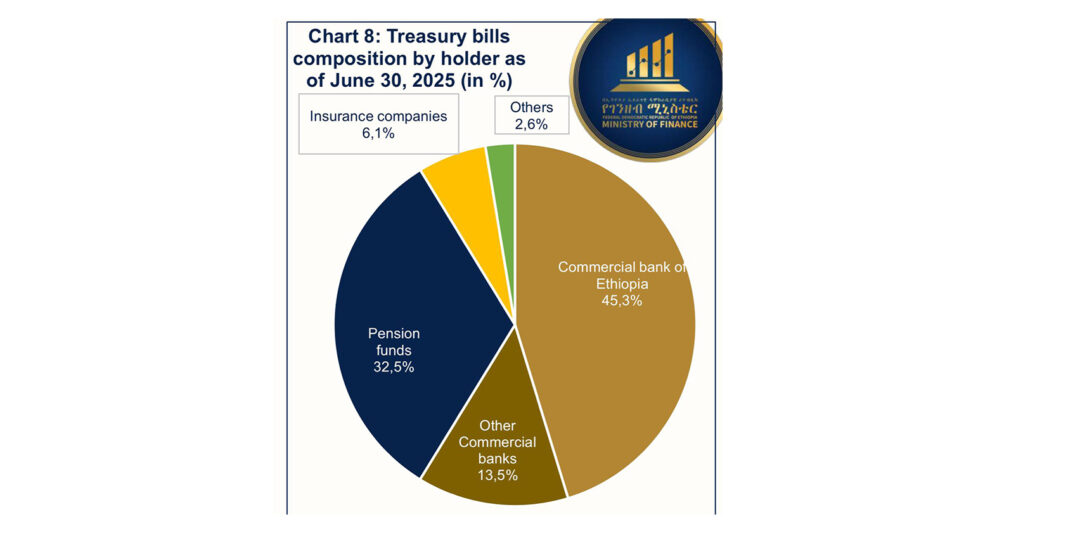

Regarding debt holders, the state-owned Commercial Bank of Ethiopia (CBE) remains the dominant creditor, holding 44% of all outstanding domestic debt.

The National Bank of Ethiopia accounts for 27%, and pension funds hold 18%. This pattern is mirrored in T-bill holdings: CBE holds 45.3% of outstanding T-bills, followed by pension funds at 32.5%, and other commercial banks at 13.5%. Insurance companies hold 6.1%, while other institutions, including Ethiopian Investment Holdings, account for 2.6%.

The bulletin also highlighted key operational enhancements, including the trading of 182-day T-bills on the Ethiopian Securities Exchange (ESX) and the government’s transition toward fully electronic transactions. These initiatives aim to increase the market’s efficiency, accessibility, and reliability.

The government has announced plans to finance its budget deficit by borrowing from the market rather than taking direct advances from the central bank—a practice that has previously contributed to inflation.

For Ethiopia’s 2025/26 budget year, the approved budget of 1.93 trillion birr carries a deficit of 22%, amounting to 417 billion birr.

The government plans to finance this deficit through a shift to market-based mechanisms, relying on domestic sources such as Treasury bills and other instruments, alongside international budget support.