In an exclusive interview with Capital, Etihad Airways CEO Antonoaldo Neves discusses the strategic rationale behind the airline’s ambitious global expansion and record profitability. The conversation focuses on Etihad’s groundbreaking joint venture with Ethiopian Airlines, marking the airline’s inaugural regular service to the major African hub of Addis Ababa. Neves emphasizes that this partnership is a fundamental aspect of a larger strategy to grow through alliances rather than in isolation, describing it as a “unique” collaboration between a Middle Eastern and an African carrier.

In addition to this pivotal partnership, Neves outlines Etihad’s aggressive network expansion, which aims to introduce a “world record” of 30 new destinations within two years, and highlights the key factors contributing to its AED 1.1 billion profit for the first half of 2025. He also addresses a pressing challenge facing the aviation industry: the global aircraft shortage, revealing that Etihad could deploy an additional 20-25 aircraft immediately if they were available. This interview offers a comprehensive insight into a carrier experiencing significant growth, strategically leveraging partnerships to thrive in a constrained and competitive global market.

Capital: You describe Etihad as a major regional airline, yet this is your first regular service to the significant African hub of Addis Ababa. What was the strategic reasoning behind the timing of this launch?

Antonoaldo Neves: We are excited to be in this extraordinary country. While timing is always a consideration—sometimes you arrive early, sometimes late—the most critical factor is that we have arrived and are committed for the long term. Importantly, we are not here alone; we have a fantastic partner in Ethiopian Airlines, who is providing tremendous support. The collaboration between Etihad and Ethiopian is what truly matters to us.

Capital: On the inaugural flight, Ethiopian Airlines CEO Mesfin Tasew described the partnership as “very unique.” From Etihad’s perspective, what specific factors make this joint venture stand out in the aviation industry?

Antonoaldo Neves: This partnership is genuinely unique for three key reasons. First, it represents the first joint business agreement between a Middle Eastern carrier and an African carrier—an unprecedented achievement. Second, although our networks and products differ, we are airlines of similar size, and more importantly, we share a comparable approach to conducting business. This alignment is distinctive. Third, it bridges the significance of the UAE in the Middle East with the importance of Ethiopia in Africa. As the national carriers of our respective countries, uniting two strong, profitable brands known for exceptional customer service benefits everyone.

Capital: How does this partnership with Ethiopian Airlines fit into Etihad’s broader strategic plan for growth and profitability, especially in the African market?

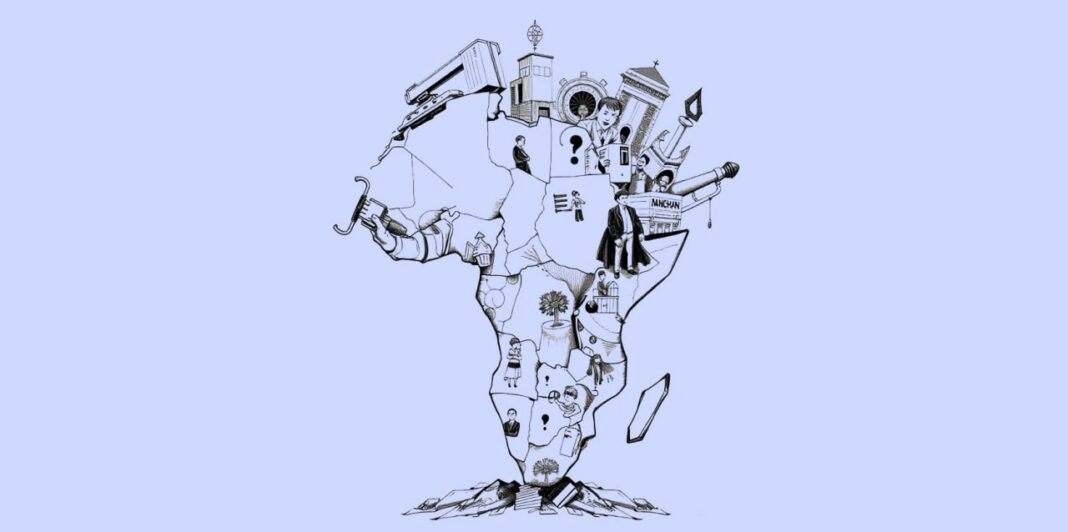

Antonoaldo Neves: It aligns perfectly. Our strategy is to grow alongside strong partners. We have joint ventures with carriers like China Eastern in Asia and SF Express in cargo. To make a meaningful entry into Africa, partnering is the best approach. This is central to our strategy: by leveraging Ethiopian Airlines’ network, we can effectively access over 50 destinations across the continent.

Capital: How would you describe the importance of this new route in terms of mutual investment and its potential to enhance tourism and economic exchange between the UAE and Ethiopia?

Antonoaldo Neves: This route signifies a substantial mutual investment. Initiating a daily flight to a new destination involves allocating at least $50 million in assets. Etihad is investing in Addis Ababa, while Ethiopian Airlines is investing in Abu Dhabi. When two countries collaborate on investments, it stimulates development. We anticipate a growth in tourism, cultural exchange, and trade. This connection links Abu Dhabi—a capital hub with over a trillion dollars in sovereign wealth—to Addis Ababa, a crucial political and diplomatic center for Africa. It’s a powerful partnership.

Capital: This route is one of several new destinations Etihad has announced this year. Can you detail your network expansion strategy for the remainder of this year and into next year?

Antonoaldo Neves: We have announced 30 new destinations this year, with Addis Ababa being the 10th launched. We plan to introduce eight more by year-end, totaling 18 new routes in 2025. Next year, we aim to add about 12 more. Launching 30 new destinations within two years is, to my knowledge, a world record. This expansion is truly global, featuring new routes in the US, such as Charlotte; in Europe, including Prague and Warsaw; in Southeast Asia, like Chiang Mai; and in Africa, with Nairobi and now Addis Ababa.

Capital: Etihad recently reported a record profit of AED 1.1 billion for the first half of 2025. What have been the key factors driving this strong financial performance, and what are your expectations for the full year and into 2026?

Antonoaldo Neves: The main driver is our team’s dedication, passion, and exceptional execution capabilities. Without them, this success wouldn’t be possible. We have fundamentally transformed our network, doubling our passenger count from 10 million in 2022 to 22 million this year. Alongside this growth, we have made significant investments in our product. We diligently track customer satisfaction, receiving over 500,000 feedback responses annually, and we have utilized those insights for targeted improvements. The combination of a motivated team, strategic network growth, and product investment has fueled our profitability.

Capital: Last week, the CEO of Ethiopian Airlines mentioned that aircraft shortages are a significant barrier to growth. What is the current situation at Etihad regarding fleet capacity, and how are you addressing these global supply chain challenges?

Antonoaldo Neves: Aircraft shortages are indeed a major constraint on growth across the industry. Etihad’s situation has been unique over the past three years. Unlike many of our peers, we had several temporarily grounded aircraft and low utilization rates, providing us with an internal reservoir of capacity to scale up without facing immediate shortages.

However, that advantage has now passed. The current reality is clear: I could immediately deploy an additional 20 to 25 aircraft if they were available. Demand is strong, but supply is lacking. If we were to place an order for a new wide-body aircraft today, delivery would not occur until 2031 or 2032. This presents a significant industry challenge with no quick or easy solution.

Capital: What are your expectations for the new Addis Ababa route? Do you anticipate increasing flight frequency or capacity soon based on initial demand?

Antonoaldo Neves: We definitely aim to expand. We began with a solid foundation of double-daily flights, with one operated by each airline. As my friend Mesfin, the CEO of Ethiopian, put it, “it’s our fight—we do it together.” My goal is to double that to four flights a day. While I can’t provide a specific timeline, we will add more capacity as soon as we can.