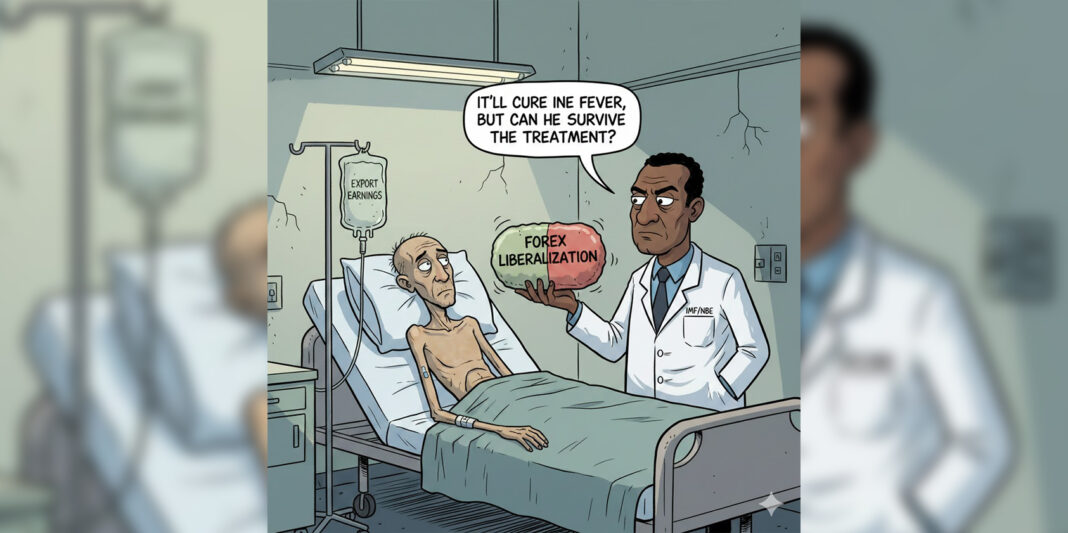

Foreign Exchange Reform: Necessary Medicine or Premature Exposure?

The National Bank of Ethiopia’s sweeping amendments to the foreign exchange regime mark one of the most consequential policy shifts in recent years. The reform broadens foreign currency retention for exporters and service providers, eases repatriation rules for investors, and grants banks and forex bureaus greater operational flexibility. It is, without question, a decisive move toward a more market-oriented foreign exchange system.

The reform is also closely aligned with Ethiopia’s commitments under its IMF-supported program. The IMF has emphasized exchange rate flexibility, strengthened monetary policy, and structural reforms as central pillars of its Extended Credit Facility arrangement with Ethiopia. In that sense, the direction of policy is neither accidental nor isolated; it is part of a broader stabilization and reform framework.

Yet the essential question remains: is this the right reform at the right time?

Ethiopia’s foreign exchange shortages are not merely the product of regulatory rigidity. They reflect deeper structural imbalances. Export growth has persistently lagged behind import demand. The country’s foreign currency earnings remain concentrated in a limited range of commodities. Industrial diversification is incomplete. Institutional capacity, though improving, continues to face constraints. In short, the chronic FX shortage is rooted in structural production and competitiveness gaps, not only in administrative controls.

Liberalizing the forex regime addresses pricing distortions and allocation inefficiencies. It may improve transparency, enhance investor confidence, and reduce parallel market pressures. But if the real economy does not generate significantly more foreign currency, greater flexibility alone will not eliminate scarcity. Markets cannot allocate what does not exist.

There are also transitional risks. Adjustments to exchange rate mechanisms can expose financial vulnerabilities. Recent reporting suggests that exchange rate realignments have already carried significant financial implications for the central bank and broader financial system. Such strains underline the importance of sequencing and institutional preparedness.

This raises a critical concern: is Ethiopia liberalizing the foreign exchange framework before the productive base is strong enough to sustain it? If exporters cannot rapidly scale up earnings and structural bottlenecks remain unresolved, the reform may ease procedures while leaving underlying imbalances intact. In that case, volatility rather than stability could follow.

That said, postponing reform indefinitely would also carry costs. Maintaining tight controls in the face of persistent shortages risks entrenching distortions, discouraging investment, and widening the gap between official and parallel market rates. The previous system was clearly unsustainable. Reform was inevitable.

The true test, therefore, is not whether forex liberalization is correct in principle—it is—but whether it is accompanied by equally forceful structural transformation. Export competitiveness, industrial productivity, logistics efficiency, agricultural modernization, and institutional strengthening must advance in parallel. Without this deeper economic renewal, foreign exchange reform risks becoming a technical adjustment layered over structural fragility.

Ethiopia stands at a pivotal juncture. If the reform catalyzes confidence, attracts investment, and stimulates export expansion, it could mark the beginning of a more resilient macroeconomic framework. If structural constraints persist unaddressed, however, the policy may expose rather than resolve vulnerabilities.

The reform is necessary. Whether it proves sufficient depends on what follows.