In an era marked by global supply chain volatility and mounting pressure for economic self-reliance, Ethiopian Shipping and Logistics (ESL) is positioning itself at the forefront of Ethiopia’s trade transformation. As the nation’s primary maritime gateway and a central pillar of import–export activity, the enterprise is undergoing a far-reaching shift—from a conventional cargo carrier to a fully integrated, internationally competitive logistics provider.

The company recently achieved a major corporate milestone by securing ISO 9001:2015 Quality Management System (QMS) certification, following more than three years of institutional reform, process standardization, and digital modernization. For CEO Abdulber Shemsu, however, the accreditation represents a starting point rather than a destination.

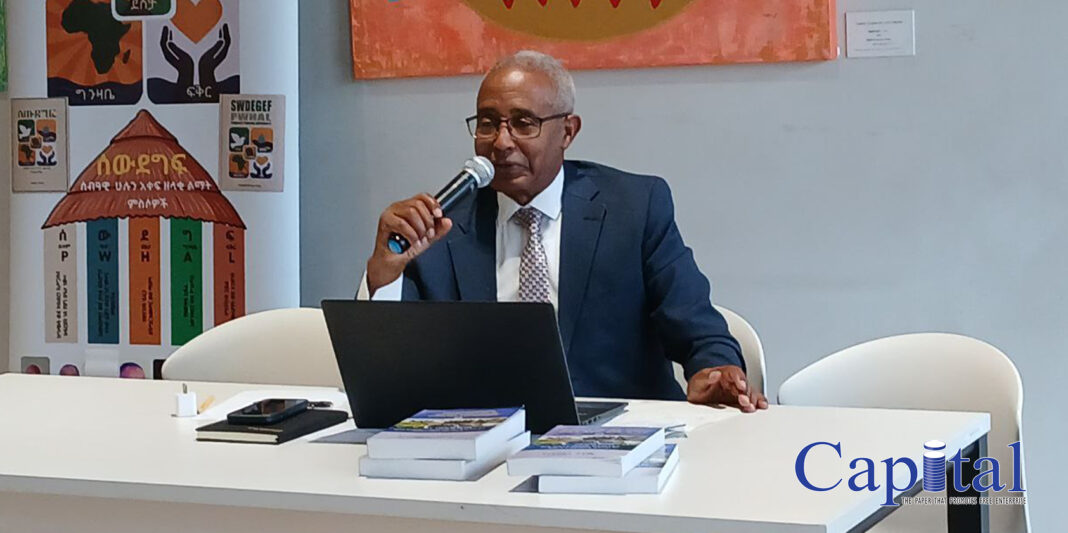

In an exclusive interview with Capital, Abdulber discusses ESL’s transition from second-party logistics (2PL) toward third-party (3PL) and ultimately fourth-party logistics (4PL) services, the expansion of its global footprint through vessel acquisitions and joint ventures, and the strategic choices being made amid Red Sea instability. He also outlines how the enterprise is balancing asset ownership with outsourcing, accelerating digital transformation, and stabilizing Ethiopia’s supply chain during turbulent times. Excerpts:

Capital: What does receiving ISO 9001:2015 certification signify for your organization and customers?

Abdulber Shemsu: Securing ISO 9001:2015 is a landmark achievement for our institution. More importantly, it establishes a structured framework that allows us to continuously and sustainably improve our services. Every process is now standardized and measured against internationally recognized benchmarks.

We view this certification as the baseline for our five-year strategic plan, which aims to position ESL as a world-class logistics provider operating in full alignment with global standards. With end-to-end digitalization and standardized quality management, we are strengthening our credibility as a preferred international partner.

Capital: What did the preparation process entail?

Abdulber: The journey took more than three years. ISO standards require that every task and procedure be evaluated within a formal quality management system. Given the scale of our domestic and international operations, this was a comprehensive undertaking.

We conducted multiple audit phases, implemented corrective measures, restructured departments, and delivered targeted training across our branches. Today, the vast majority of audit findings have been addressed, and dedicated teams are in place to ensure continuous compliance and improvement.

Capital: Are you pursuing additional certifications, particularly in safety and environmental standards?

Abdulber: Absolutely. While QMS certification is foundational, our shipping and port operations require adherence to specialized safety and environmental standards. As we expand into e-commerce and integrated logistics, compliance becomes even more critical.

“This certification is merely the beginning—it represents the baseline. Without it, progress is not possible, and we have no intention of regressing.”

Within the coming year, we plan to secure further safety and environmental certifications to reinforce our operational excellence.

Capital: The institution plans to evolve from 2PL to 3PL and eventually 4PL. What investments support this ambition?

Abdulber: Currently, ESL operates as a 2PL provider. Transitioning to 3PL means managing the entire supply chain—from consolidation and packaging to door-to-door delivery. Ultimately, 4PL would position us as a full supply chain integrator.

We do not intend to rely solely on our own assets. For example, we utilize the Ethio-Djibouti Railway for rail transport rather than investing in redundant infrastructure. In road transport, we combine our own fleet with outsourced trucking services. Similarly, when cargo exceeds our vessel capacity, we collaborate with other carriers.

Our focus is on optimizing capacity and efficiency—not merely expanding asset ownership.

Capital: What progress has been made in digitalization and ERP implementation?

Abdulber: Reducing Ethiopia’s high logistics costs is a national priority. Lower logistics expenses ensure that goods remain affordable and that perishable commodities reach the market before spoilage. As Ethiopia’s principal gateway to global trade, Ethiopian Shipping and Logistics handled more than 40 percent of the country’s imports this year, with the remainder managed by foreign carriers. Managing such scale efficiently requires robust systems, and we have therefore fully integrated an enterprise resource planning (ERP) platform across our operations.

Beyond ERP integration, we are rolling out advanced digital platforms that enable customers to access our services remotely. These include end-to-end traceability, online booking, digital price negotiation, and a mobile application that provides real-time tracking of cargo from origin or warehouse to final destination. The system will be inaugurated shortly and is expected to significantly enhance transparency, operational efficiency, and cost competitiveness across the supply chain.

Capital: What are the core objectives of your five-year strategy?

Abdulber: Shipping remains the cornerstone of our business. Over the next five years, we plan to acquire 16 additional vessels, six of which are scheduled for procurement within the current fiscal year. This expansion is designed to strengthen our fleet capacity, enhance service reliability, and reinforce our competitiveness in international markets.

We also aim to generate more than $1.7 billion in foreign currency by expanding cross-border services beyond the transportation of Ethiopian cargo. For the 2022 Ethiopian fiscal year (2030 G.C.), we are targeting annual revenue of 295 billion Birr, alongside a proportional increase in net profit.

In parallel, we intend to establish joint ventures or strategic shareholdings in at least four countries to broaden our global footprint. A central milestone of our five-year roadmap is completing the transition from a second-party logistics (2PL) provider to a fully integrated third-party logistics (3PL) operator, positioning us to manage supply chains end-to-end and deliver greater value to our customers.

Capital: How has performance been over the past six months?

Abdulber: Our performance has surpassed expectations. In the last six months, we generated 74.4 billion Birr in revenue—a 59 percent increase year-on-year.

We transported nearly 59,000 TEUs in multimodal operations, while vessel utilization rose by over 92 percent. In dry bulk fertilizer shipments, we exceeded our target by transporting 1.2 million metric tons—160 percent of our planned volume—without incurring demurrage charges. 84% of the fertilizer transported inland was moved by truck and 16% by rail.

Capital: How has the Red Sea security crisis affected your operations?

Abdulber: Ethiopia is the only African country operating its own national fleet in the volatile Red Sea corridor. While several countries rely solely on liner services, Ethiopia operates on a Direct Port Cargo (DPC) basis, giving us greater operational flexibility during crises.

When security tensions escalated and major liner operators suspended transit through the Suez Canal, Ethiopian cargo was stranded at multiple transshipment hubs. In response, we mobilized our vessels to provide feeder services, moving goods from nearby ports to Djibouti to prevent prolonged supply disruptions. As stability gradually returned, international liners resumed passage through the canal.

Under normal circumstances, we allocate part of our fleet to cross-trade services for other countries. However, when international slot rates surged sharply—rising, for example, from $5,000 to $7,000 for a 40-foot container—we intervened to protect domestic importers. We diverted vessels from high-yield cross-trade routes and reassigned them to prioritize Ethiopian cargo, ensuring continuity of supply at more manageable costs.

This was a deliberate market-stabilization measure. While the move contributed positively to overall revenue, it reduced our projected foreign currency earnings. We had anticipated $150 million in forex revenue but realized $134 million. The $16 million gap reflects a conscious decision to cushion the national economy rather than pursue maximum short-term gains from international cross-trade operations.