The light in his eyes revealed a blend of ambition, pride, and the exhilarating fear that accompanies growth. Seated across from me in my office, my client shared his plans. His small manufacturing enterprise, once a humble workshop, was gaining traction. Orders were increasing, his product was gaining recognition, and the path forward was clear: he needed to scale. We reviewed his finances and projected cash flows, reaching a unanimous conclusion: to fuel his ambition, he required capital. A bank loan was the necessary next step.

However, this is where his story took a disheartening turn. That enthusiasm and hope quickly transformed into disbelief and then into an exhausted sigh of resignation. The once-manageable ladder of success was now lined with exorbitantly high and unpredictably shifting interest rates. His experience is not unique; it reflects a profound paradox at the heart of Ethiopia’s current business climate.

In Ethiopia, the credit lifeline for SMEs and larger enterprises is effectively monopolized by banks, creating what many describe as a supplier’s market. Banks possess extraordinary power to set the price of money—interest on loans—often embedding loan covenants that allow them to unilaterally increase rates at any time and for any reason. The borrower’s consent is irrelevant; their need becomes the bank’s leverage.

The pressure on banks is palpable, creating a two-way squeeze that ultimately falls on the borrower. With a limited capital base and an intense scramble for deposits, banks are compelled to attract savers by offering irrationally high fixed time deposit rates. This costly capital, acquired through aggressive marketing for every birr, cannot be absorbed easily. It is inevitably passed on, with a margin, to the business owner, who must now bear a financial burden that is both stressful and expensive to manage.

From my perspective as a consultant in private sector development and access to finance, this situation is deeply concerning. We are facing a missed opportunity. Countless businesses, brimming with viable ideas and tangible market potential, are being denied the necessary resources to grow and thrive. Instead of planning expansions, many are downsizing operations, paralyzed by the fear that rising interest rates and inaccessible loans render the future uncertain.

The consequences of this credit crunch extend far beyond the entrepreneur’s balance sheet. The general public ultimately bears the burden. We see it reflected in declining employment opportunities as businesses freeze hiring, in shortages of consumable goods as production scales back, and in stagnant innovation stemming from a risk-averse business environment. It is a silent tax on progress, paid by everyone.

The irony is striking: the very institutions that aggressively attract account holders with vibrant marketing campaigns and promotional gifts simultaneously enforce fee and interest structures that reflect anti-competitive behavior. This situation is akin to a merchant hoarding a necessity like sugar to create artificial scarcity, only to complain about regulatory intervention when finally held accountable.

This raises a critical question: Why must entrepreneurs sign loan covenants that allow interest rates to rise without limits, clarity, or recourse? The absence of alternatives does not justify subjecting customers to abusive terms.

Imposing crippling terms on merchants inevitably affects us all. When businesses are pressured, they face two choices: fail or pass on the costs. Those that survive do so by raising prices for their goods and services, contributing directly to the inflationary pressures that already burden the economy. In this vicious cycle, even banks will not escape the consequences. A weakened private sector cannot generate the deposits, take the loans, or drive the economic activity that banks need to thrive in the long term.

The solution is not straightforward, but it must start with acknowledgment. We must recognize that the current model is unsustainable. Creating a more competitive financial landscape with diverse financing options—from microfinance institutions aimed at growth to the potential of capital markets—is essential. Greater transparency and fairness in loan pricing and covenants are not anti-bank; they are pro-economy.

The ambition of my client and thousands like him is Ethiopia’s greatest economic asset. It drives job creation, innovation, and national prosperity. We must not allow that ambition to be the casualty of a broken financial system. We need to rebuild it, one fair and transparent step at a time, before the dream of growth gives way to stagnation for us all.

To break free from this cycle and reaffirm their role as engines of growth, Ethiopian banks must innovate beyond their traditional, dependency-driven business models. This means developing novel, risk-sharing financial products and transforming from mere lenders into genuine investment partners committed to the long-term success of their clients and the broader economy.

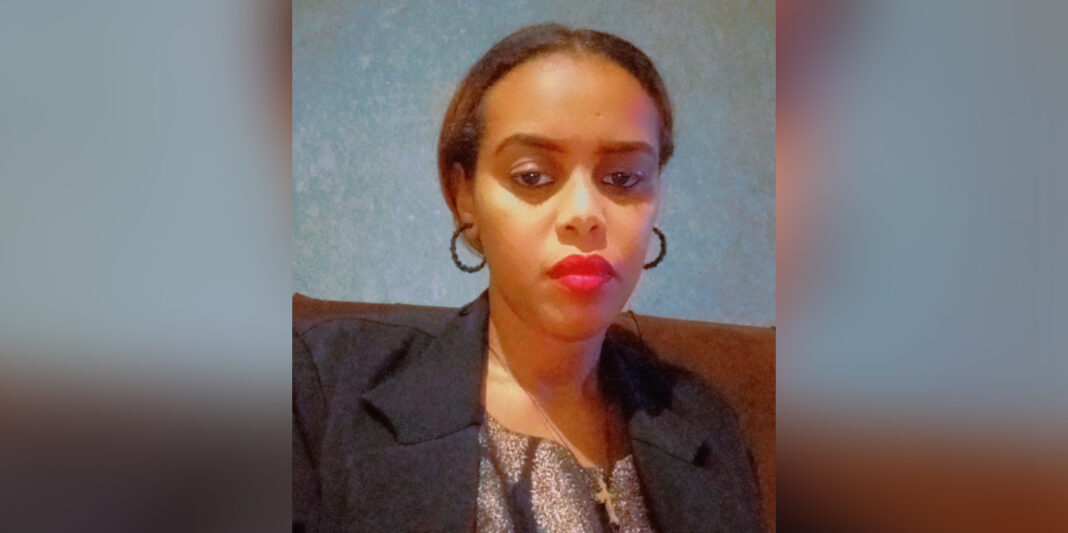

Befikadu Eba is the Founder and Managing Director of Erudite Africa Investments, a former banker with a strong interest in private sector development and financial inclusion. He can be reached atbefikadu.eba@eruditeafrica.com.