Atieno Otonglo, Africa Lead at the Global Steering Group for Impact Investing (GSG Impact), brings over 17 years of experience in impact investing and business development across emerging markets to her role supporting the development of impact investing ecosystems in Africa. With an MBA from London Business School, Atieno leads efforts to build infrastructure and incentives that encourage capital flow for measurable social and environmental impact throughout the continent. In an exclusive interview with Capital, she shared insights into how GSG Impact’s initiatives in Ethiopia will differ from other African countries, the challenges they anticipate, and the opportunities for transformative investment that align with Ethiopia’s unique economic landscape. Excerpts;

Capital: How will GSG Impact’s work in Ethiopia differ from its efforts in other African countries, given Ethiopia’s unique economic landscape?

Atieno Otonglo: Ethiopia is in the early stages of developing its impact investing ecosystem. Unlike more mature markets such as South Africa, Egypt, Kenya, or Nigeria, Ethiopia has limited experience with blended finance, social enterprises, and impact-driven investments. We anticipate our role here will be more catalytic, focusing on building awareness, convening the ecosystem, and enhancing capacity. Our goal is to adapt global insights to Ethiopia’s specific context, where the government plays a significant role in the economy and private sector participation is still growing.

Capital: What are the biggest challenges you expect in establishing a robust impact investing ecosystem in Ethiopia? How can GSG Impact help address these challenges?

Atieno: The primary challenges include: (i) a lack of awareness among local investors about impact investing, (ii) a scarcity of investment-ready enterprises, (iii) regulatory barriers limiting alternative financing, and (iv) high collateral requirements from banks. The Ethiopian national partner can assist by collaborating with government entities on regulatory reforms, training enterprises to become investment-ready, and facilitating partnerships with strategic development partners and global impact investors.

Capital: What is the largest potential source of capital in Ethiopia, particularly from pension funds or private investors?

Atieno: In many African countries, the most significant long-term capital pool comes from pension funds and insurance companies. Ethiopia’s pension system is expanding, and directing even a small portion into impact-aligned investments could be transformative. Family businesses and diaspora networks also present promising sources of private capital.

With an estimated US$40–45 billion in assets under management, EIH is currently Africa’s largest sovereign wealth fund. Its investment decisions influence Ethiopia’s financial markets. If EIH incorporates impact principles into its strategy, it will send a strong message to banks, pension funds, and private investors that aligning financial returns with social and environmental outcomes is both valid and expected. Furthermore, EIH can catalyze blended finance, creating opportunities for pension funds, insurance companies, and diaspora capital to co-invest in impact vehicles that support Ethiopia’s development priorities in job creation, rural transformation, health, and climate resilience.

Capital: Which small and medium-sized enterprises (SMEs) in Ethiopia are likely to benefit the most from this initiative? What areas do you prioritize?

Atieno: The beneficiaries of impact investing will span various sectors. However, in the Ethiopian context, SMEs in agriculture, renewable energy, health, and education are likely to gain the most. These sectors not only align with Ethiopia’s development priorities but also offer scalable business models with significant social impact. We place particular emphasis on women- and youth-led enterprises.

Capital: How can the Ethiopian National Partnership for Impact Investment collaborate with existing organizations such as Social Enterprise Ethiopia?

Atieno: Collaboration is vital. Social Enterprise Ethiopia has grassroots connections with entrepreneurs, while the Ethiopian National Partnership for Impact Investment can provide policy and investor engagement. Together, they can create a pipeline of enterprises, advocate for enabling regulations, and enhance Ethiopia’s presence in global forums.

Capital: Can you explain the differences between traditional investing, ESG investing, and impact investing in simple terms for our readers who are just familiar with these concepts?

Atieno: Traditional investing focuses solely on generating financial returns. ESG investing considers environmental, social, and governance factors to manage risks and enhance long-term value. Impact investing goes further by intentionally pursuing measurable positive social and environmental outcomes alongside financial returns.

Capital: The GSG has a report with recommendations for banks. What is the key message for Ethiopian banks regarding their role in impact investing?

Atieno: Banks should view themselves as partners in development, not just as lenders. By creating innovative financial products, reducing collateral requirements, and collaborating with impact investors, banks can unlock opportunities for SMEs that are otherwise excluded.

Our latest report on this topic, A New Lens on SME Mobilisation: How to Maximise Private Capital Flows to SMEs, found that traditional methods of capital mobilization for SMEs yield disappointing results. Seventy-five percent of DFI commitments to SMEs are channeled through domestic commercial banks and local or regional SME funds. However, there is minimal evidence of private capital mobilization occurring at the point of DFI investment through these channels. Alternative approaches show more promise and should be better understood. Mobilization often occurs downstream from DFI investments; after receiving DFI support, banks may use their own capital to increase SME lending, and funds may assist investee companies in securing follow-on funding from local sources. We refer to these market-building efforts as “secondary mobilization,” which is capital attracted due to DFI support and influence over banks and funds. This is significant and can help address the funding shortfall that SMEs in EMDEs face. However, DFIs need strategies to maximize this mobilization and must measure it effectively.

Capital: You mentioned that in Kenya, pension funds are not fully utilizing the new rule allowing investments in alternatives. Why do you think this is happening, and how can Ethiopia avoid a similar situation?

Atieno: In Kenya, the slow uptake can be attributed to a lack of awareness, risk aversion, and limited investment vehicles. Ethiopia can avoid this by: (i) building capacity for pension fund managers, (ii) developing local impact funds as investment vehicles, and (iii) ensuring regulatory clarity and providing investor education from the outset.

Capital: Can you share a successful experience from another African country that could serve as a model for Ethiopia?

Atieno: Across Africa, we are piloting transformative initiatives to enhance financial inclusion and support small and medium enterprises (SMEs).

In Ghana, our national partner is implementing the $75 million Ci-Gaba fund-of-funds, designed to mobilize pension fund capital for SDG-aligned SMEs. In Zambia, our national partner is collaborating with the local Central Bank on the Small Business Growth Initiative (SBGI), a $180 million credit guarantee facility that addresses critical financing gaps for SMEs, including issues related to informality, collateral requirements, and high interest rates. In Nigeria, our national partner is launching the Wholesale Impact Investment Fund (WIIF), a $1 billion naira-denominated fund-of-funds aimed at supporting SMEs in sectors like agriculture, education, health, energy transition, and the creative industry. The fund has already secured a first close of $100 million, with contributions split 50% between the Federal Government of Nigeria and the private sector, while emphasizing gender as a cross-cutting theme.

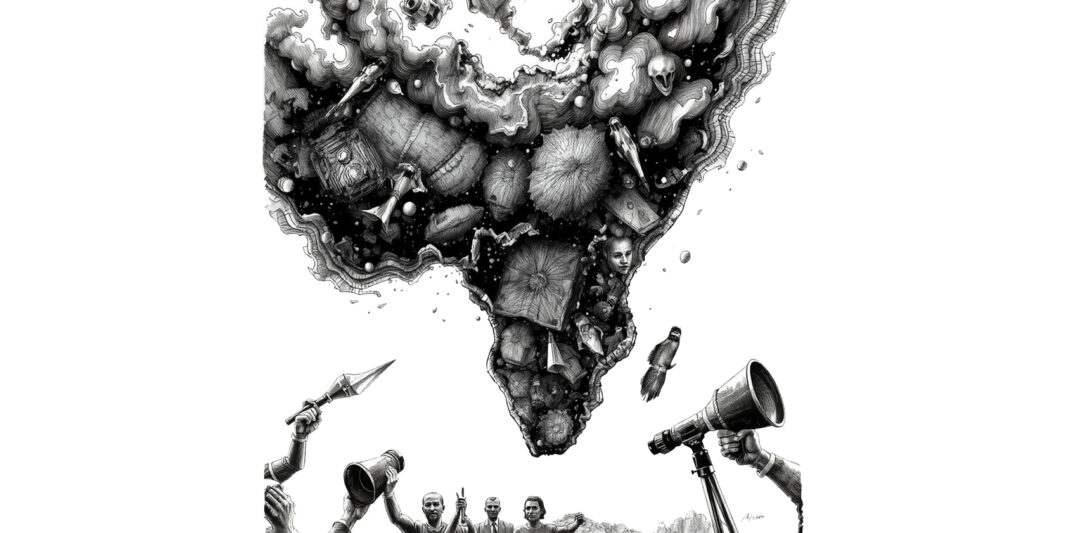

Through these national initiatives across the African continent, GSG Impact aims to transform local financial ecosystems, stimulate job creation, and promote inclusive economic development in key sectors such as agriculture, renewable energy, and education.

Capital: How can the GSG initiative address the issue of high collateral and interest rates that currently hinder small businesses in Ethiopia?

Atieno: Through advocacy and partnerships, we encourage banks to adopt risk-sharing mechanisms and blended finance models that reduce the risk for lenders. Guarantee schemes and concessional capital can also alleviate the collateral burden for SMEs.

Capital: How can the GSG organization help Ethiopian businesses become “ready for investment” to attract impact capital?

Atieno: The Ethiopian national partner will collaborate with accelerators, incubators, and capacity-building organizations to strengthen governance, financial management, and impact measurement systems within enterprises. This will prepare them to meet the requirements set by impact investors and development finance institutions (DFIs).

Capital: What do you hope to achieve in Ethiopia in the next two years?

Atieno: Our priorities include establishing a robust Ethiopian national partner for impact investing that will assist the government in implementing enabling policies, building a visible pipeline of impact enterprises, and facilitating a significant influx of local and international impact capital into Ethiopian businesses.

Capital: What are the main systemic barriers to impact investing in Ethiopia, and how are GSG and the new national partner working to overcome them?Atieno: The barriers include restrictive regulations, a lack of investment-ready enterprises, limited awareness, and underdeveloped financial markets. Together with the Ethiopian national partner, we will address these challenges by fostering policy dialogue, building enterprise capacity, and connecting global investors with local opportunities