The deadline for the Commercial Bank of Ethiopia (CBE) to reduce its on-balance sheet net open position (NOP) by at least half has been extended to March 2026 due to lower-than-expected foreign currency inflows. This extension, highlighted in a recent International Monetary Fund (IMF) document, moves the original compliance deadline from the end of 2025.

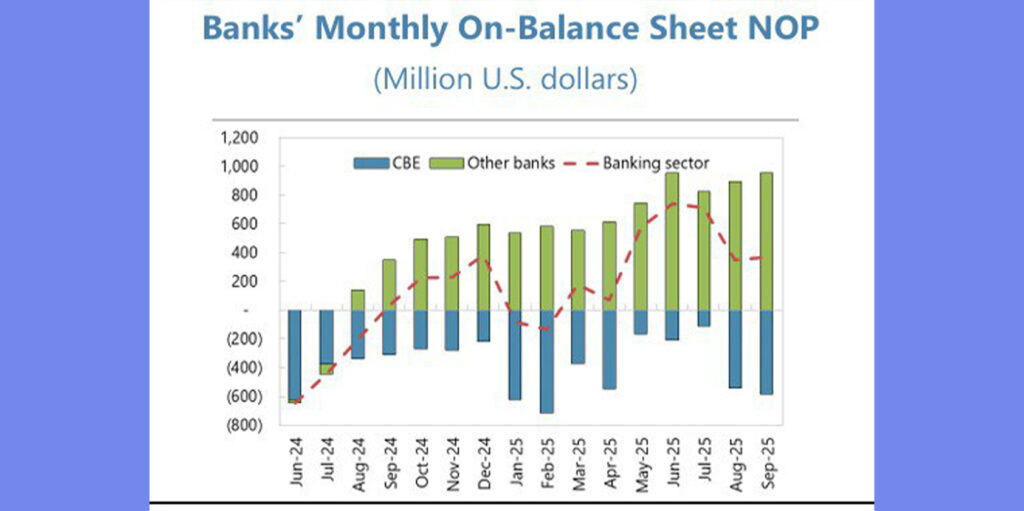

The adjustment follows a larger-than-anticipated NOP in the first quarter of the 2025/26 financial year, caused by weaker foreign exchange receipts, primarily from remittances, and increased demand for foreign currency, particularly from the private sector.

To monitor progress against a revised plan that includes a contingency buffer, the National Bank of Ethiopia (NBE) and CBE have initiated weekly consultations. In addition, CBE has launched new initiatives aimed at mobilizing foreign exchange resources from diaspora communities, such as targeted remittance campaigns and customized loan products. The IMF has suggested that CBE may need to adopt more competitive pricing and actively participate in foreign exchange auctions to successfully close its NOP.

Industry experts find CBE’s declining remittance inflows unsurprising, given the attractive incentives offered by other banks and dedicated money transfer companies. Despite government and central bank efforts to curb illegal channels, intense competition among various players continues to impact remittance flows.

According to the IMF, NBE and CBE have agreed on a plan to ensure that the bank complies fully with the revised NOP Directive by March 2026. An Asset Quality Review of CBE’s lending portfolio is also scheduled for completion by the end of June 2026.

Originally, under the IMF’s Extended Credit Facility third review, a time-bound plan was established to bring CBE’s NOP within prudential limits by the end of 2025, requiring at least half of the excess position as of April 2025 to be eliminated by the end of September 2025.

However, CBE’s NOP deteriorated to approximately -$500 million by the end of the first quarter of this budget year, in contrast to around -$200 million at the close of the previous year.

The IMF noted that CBE’s significant short foreign exchange position persists, partly due to its role in financing fuel and fertilizer imports, as private banks have shown limited willingness to share this burden.

The World Bank’s Financial Sector Strengthening Project (FSSP), which provides nearly $800 million to support CBE’s capitalization, is anticipated to enhance its foreign asset position.

In November, NBE revised a 25-year-old NOP directive to more effectively regulate banks’ foreign exchange exposures and improve their capacity to conduct foreign exchange business responsibly. The updated directive aligns with international best practices and sets the overall foreign exchange risk exposure limit at +/-18% of a bank’s Tier 1 capital at the end of each business day.

NBE stated that the revision aims to allow banks greater flexibility in managing foreign exchange positions to meet customer needs, ensure a functional foreign exchange market, and enhance foreign exchange availability at competitive rates through the establishment of maximum holding limits.

The IMF observed recent improvements in foreign exchange availability in Ethiopia, noting fewer complaints about access and shorter wait times, while the real effective exchange rate has stabilized.

Strong net foreign exchange inflows, primarily from an improved trade balance in 2024/25, along with NBE foreign exchange auctions, have bolstered bank liquidity. Additionally, private banks have started opening letters of credit for fuel imports.

Further steps to enhance the functioning of the foreign exchange market include incorporating interbank foreign exchange transactions and NBE’s foreign exchange sales/purchases into the daily indicative rate, conducting surveys of unmet foreign exchange demand, and implementing the revised NOP directive, which introduces a clear penalty regime for non-compliance effective January 1, 2026.