Melaku Mulualem K.

The Four Initiatives of President Xi Jinping

Starting from 2013 onwards President Xi Jinping took four major global initiatives. These are the Belt and Road Initiative (BRI), Community of Shared Future of Mankind, Global Development Initiatives (GDI) and Global Security Initiative (GSI). The fourth initiative has been taken on the Boao Forum on 21 April 2022 when the president made an opening remarks.

These four initiatives are the reflection of the foreign policy of China that underlines the promotion and cooperation of countries around the world. Similar with the foreign policy, GSI will follow “mutual respect, equality, mutual benefit and peaceful coexistence, follow a policy of good-neighborliness and friendship”. The four initiatives are complementary to one another. The president puts forward these initiatives to solve global problems through cooperation and partnership. All initiatives request the participation of least developed countries, developing countries, and developed countries. Developed countries are expected to support the initiatives in alleviating the critical problems of economically weak countries.

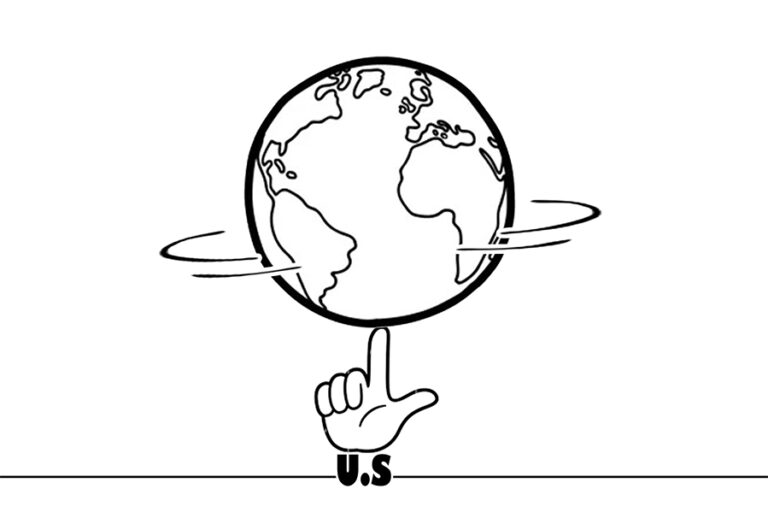

The four initiatives are open to all governments of the world to be part and parcel in solving global economic and security challenges. All of them focus on global peace, security and developments. They are moves of China from my national interests to international interests. These show that China is stepping forward from a national vision to a global vision as well as balancing national interests with international interests.

The Boao Forum

Broadly speaking there are three types of security i.e international or global security, state security and human security. They are inseparable to one another. Global security focuses on ending global problems. In the annual Boao Forum for Asia President Xi Jinping clarified the concept and importance of the Global Security Initiative. He has underlined that security and development are intermingled to one another. The impact on one will be reflected on the other.

According to the Global Security Initiative, there are six commitments.These are:

the vision of common, comprehensive, cooperative and sustainable security, and work together to maintain world peace and security;

respecting the sovereignty and territorial integrity of all countries, uphold non-interference in internal affairs, and respect the independent choices of development paths and social systems made by people in different countries;

abiding by the purposes and principles of the UN Charter, reject the Cold War mentality, oppose unilateralism, and say no to group politics and bloc confrontation;

taking the legitimate security concerns of all countries seriously, uphold the principle of indivisible security, build a balanced, effective and sustainable security architecture, and oppose the pursuit of one’s own security at the cost of others’ security;

peacefully resolving differences and disputes between countries through dialogue and consultation, support all efforts conducive to the peaceful settlement of crises, reject double standards, and oppose the wanton use of unilateral sanctions and long-arm jurisdiction;

maintaining security in both traditional and non-traditional domains, and work together on regional disputes and global challenges such as terrorism, climate change, cybersecurity and biosecurity.

The Global Security Initiative is expected to solve global challenges including the Covid 19 pandemics, poverty, climate change, cyber, terrorism and security. He has also identified drivers of the security challenges namely Cold War mentality, unilateralism, hegemonism, double standards, power politics through group politics and bloc confrontation. To counter these challenges, there is a need to organize global cooperation, and partnership, and promote multilateralism. The main objective of GSI is to provide a solution to the above-listed global problems and to make this world safe and secure.

President Xi also forwarded a promise to help Asian and African countries saying “China will follow through the pledged donation of 600 million and 150 million doses of vaccines to Africa and ASEAN countries respectively, as part of our effort to close the immunization gap”. This support will help the people of Africa and Asia to control the pandemics and move forward with development.

Global Security Initiative and Africa

Most of the United Nations Peace Keeping Missions are located in Africa. This shows that Africa has grave security challenge. From the initiative of President Xi Jinping Africa will benefit the most. To maintain global security there is a need to have highly sophisticated technology in harvesting information and neutralizing grave security challenges. Most African countries do not have that technology and facilities. Thus Global Security Initiative is the most welcoming idea to be embraced by Africa.

Of Course China has sent her troops through the United Nations Peace Keeping Missions to Africa. This is one indication that China needs peaceful Africa. In addition to this recently China has appointed an envoy to the Horn of Africa to support peace and security in the region. The Global Security Initiative will make the support of China to Africa holistic and cover wider areas in the continent.

Taking initiative doesn’t mean shouldering all responsibilities. This means that other countries should also play their role to make this world safe and sound. Especially developed countries should support such initiatives so that poor countries can get out of security challenges.

Since the emergence of the Covid pandemic, the problem in Africa is increasing by leaps and bounds. Health and security are highly related to one another. African governments could not provide enough health facilities to counter the pandemic, as a result of it people are dying, the number of unemployed people has increased very fast, poverty and hunger are escalating, donor communities have minimized their support and shortage of hard currency impacted the foreign trade and the like.

African people are highly affected by Covid 19 and its related consequences. This global pandemic can be solved through global partnership. As long as China is willing to support countries in controlling the spread of the virus, Africa should promote and use the opportunities with great enthusiasm. Supporting GSI means supporting and implementing the fifty years plan of the African Union.

The Nexus between GSI and Agenda 2063

GSI is highly related to the Agenda 2063 of the African Union strategic framework. The fourth aspiration of the African Union says “A Peaceful and Secure Africa”. Both GSI and Agenda 2063 also promote partnership in solving common problems of governments. For instance number nineteen goal of the African Union states that the continent would continue as “a major partner in global affairs and peaceful co-existence”. This shows that to solve the problem of Africa there is a need to establish a partnership with other countries to execute its fifty-year plan effectively and efficiently.

The Way Forward

In order to implement GSI there is a need to promote the initiative through international media, various forum, put structures and modalities, synchronizing security policies of various governments to the same purpose, securing fund, making synergy with the security works of the United Nations as well as other continental and regional blocs and the like. China and Africa can strengthen their partnership and cooperation at various levels. The Africa Union has its own peace and security structure that works on conflict prevention management and resolution as well as combating terrorism and the like.

In a nutshell, China has introduced various global initiatives to solve problems of the world through cooperation and partnership. Supporting and implementing the initiative can make all beneficiaries. Especially African countries can use these great initiatives as an opportunity to solve both their internal and external challenges. African countries should welcome GSI with open arms. GSI helps maintaining security in the world to be conducted in a coordinated manner. It also synergizes the security strategies of various governments in the world.

Melaku Mulualem K. is a researcher in the Foreign Relations Institute. You can reach him via melakumulu@yahoo.com