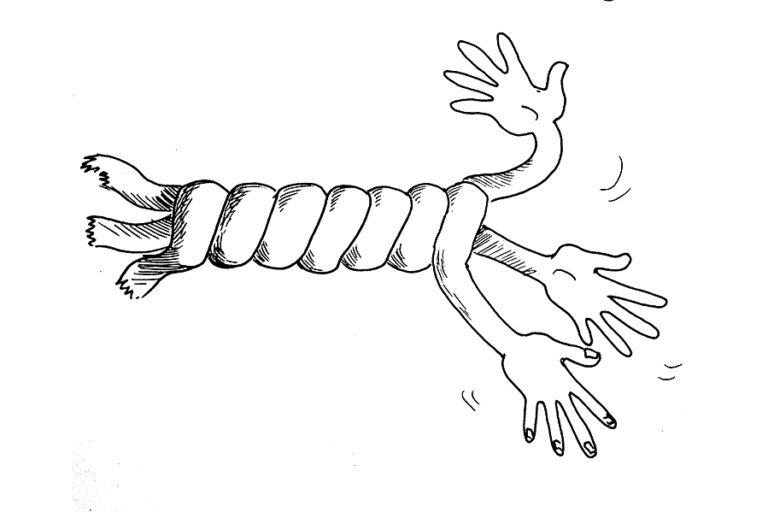

African Export-Import Bank (Afreximbank) and Portugal’s National Association of Young Entrepreneurs (Associação Nacional de Jovens Empresários – ANJE), have announced a three-year partnership to support and promote Africa’s Fashion Apparel and Textile Manufacturing Industry in Portugal and across Europe.

This partnership is part of Afreximbank’s Creative Africa Nexus (CANEX) programme, which aims to facilitate investments in Africa’s creative and cultural economy through financing, capacity building, export and investment promotion, digital solutions, linkage and partnership promotion, and policy advocacy.

The cultural and creative industries in Africa have shown that with the right investments, they have the potential to contribute to the structural transformation of the continent, thereby creating jobs and increasing exports and other development outcomes. The partnership between Afreximbank and ANJE aims to address the challenges faced by African designers, providing them with the opportunity to access international markets while building their capacity through brand incubation.

Within the framework of this partnership, ANJE, through its fashion project called Portugal Fashion, will provide African designers with showcasing platforms, facilitate their access to international markets and strengthen their capacities through business mentoring and technical assistance in apparel production. In the long-term, Afreximbank and ANJE aim to attract more investment opportunities into the sector while developing the technical skills of African industry players, thereby improving Africa’s manufacturing and production capabilities.

The programme is designed to promote at least 40 African designers annually on Portugal Fashion’s runways. Designers will also benefit from networking opportunities with international industry experts, retailers, manufacturers, and other key stakeholders. The inaugural fashion showcase will take place in Porto, Portugal from 13-16 October 2021 and will weave in Africa’s creativity in the arts including lifestyle, music, art and food.

In addition to this event, Afreximbank and ANJE have structured a partnership to advise and support European and Portuguese companies seeking to invest in Africa, where ANJE will act as a one-stop shop for investors looking into Africa and seeking advisory services and support from both Afreximbank and ANJE.

Commenting on the partnership, Prof. Benedict Oramah, President of Afreximbank, said “we believe that the vast creative talent pool on the continent is an opportunity to accelerate Africa’s economic transformation. Through CANEX the Bank is providing tangible support for the development of an ecosystem to monetise the creative sector and increase its contribution to Africa’s economy under the African Continental Free Trade Area (AfCFTA). I thank ANJE for their visionary and bold leadership. Afreximbank is pleased to partner with them to undertake this transformational initiative for Africa’s fashion apparel and textile manufacturing industry.”

Manuel Mota, Vice President of ANJE also said “the creative industries in Africa have immense potential to become key drivers for economic growth and I believe this initiative will have a positive and sustainable impact. It is a privilege for ANJE to host and work together with Afreximbank on this important milestone.”

Afreximbank, Portugal’s National Association of Young Entrepreneurs announce a 3-year partnership to promote Africa’s fashion apparel and textile manufacturing industry

Diplomat housing

Elevation Diplomatic Residences is a112-unit diplomatic spec residential tower in the heart of Addis Ababa developed by DH One Real Estate PLC (“DH One”), a joint venture between Africa Property Development Specialist, Gateway Real Estate Africa (“GREA”) and Verdant Ventures (“Verdant”), a property developer from the US with an Africa focus.

When completed and inaugurated in August this year, this 7-storey development will be the only security, seismic and international standard compliant housing development for consular staff in Ethiopia in a country distinguished as the third largest diplomatic community in the world after Washington DC and Brussels with over 130 diplomatic missions.

Capital has sat down with the CEO and co-founder of GREA, Greg Pearson joined by Tim Redman, the CEO of verdant to learn more about the project. Excerpts;

Capital: Thank-you Greg and Tim for sitting down with us. Can you briefly describe the background information of DH1’s investors and their experience across Africa?

Greg: Gateway Real Estate Africa was formed in 2018 and is a private real estate development company registered in Mauritius. We specialise in turnkey construction of accommodation for international companies and retailers who wish to expand their operations in the African continent. We create value for shareholders through development of properties, through rental income from tenanted developments that we own and through the sale of assets at the appropriate time.

Tim: Verdant Ventures is an American real estate developer and through our offices in Mauritius, Kenya and Ethiopia, focus on providing real estate solutions to our governmental and blue-chip international client base across Africa. Our close synergies with GREA led to the very successful partnership on this project and others.

Capital: Brief the success stories and experiences of Verdant Ventures and Gateway Real Estate across Africa and their unique strength.

Tim: Verdant Ventures’ senior team has collectively delivered $10B in project value worldwide. In addition to Elevation Residences, a second project in Kenya is on track for delivery in June 2022. On the success of these endeavors, Verdant Ventures has secured a robust project pipeline stretching across multiple sectors in Sub Saharan Africa.

worldwide. In addition to Elevation Residences, a second project in Kenya is on track for delivery in June 2022. On the success of these endeavors, Verdant Ventures has secured a robust project pipeline stretching across multiple sectors in Sub Saharan Africa.

Greg: From a GREA perspective, since our formation in 2018, we have raised and deployed capital into development projects in Ethiopia, Uganda, Kenya, Nigeria, Ghana, Morocco, Mauritius, and Mozambique and is currently delivering on a construction pipeline of US$400 million.

Our ability to partner with large international and local corporates on their specific corporate development needs and deliver turnkey projects on time and against budget is what sets us apart. Our executive team has deep experience, and we remain nimble enough to remain proactive when dealing with challenges. For example, despite the impact of Covid-19 across the continent, we managed to break ground on three different projects.

Capital: What led to the JV of Verdant Ventures & Gateway and Why Ethiopia?

Tim: Verdant as a group through our parent company Verdant Frontiers and sister company Verdant Consulting have been established in Ethiopia for the past 7 years with multiple investments so expanding into real estate has been a logical step.

At the time Verdant Ventures required a strong development partner and we engaged with GREA. The collaboration drew on the combined strength of both companies, providing a strong relationship with the United States Government as tenant, capital depth and development experience in Africa as well as a platform in Ethiopia.

As you know Addis is the third largest diplomatic community in the world. As home to the African Union, UNECA and several international organizations as well as being a center for showpiece summits and conference tourism, our research revealed that there is an acute and huge need for hotel room pipeline in general and a specialized need for high-end, secure and diplomatic-spec residencies for the diplomatic/expat population living in Addis.

While Ethiopia has made impressive leaps in the pipeline of chain hotel rooms of 6,281 (compared to 3,588 in Kenya and 13,851 in Egypt) in 2020, as per the report by the Lagos based W Hospitality Group, there is a desperate need for diplomatic and expat staff and their families for secure, high-end and long-term residency as well as international schooling.

Given Ethiopia aspires to maintain its ‘new Flower,’ Addis Ababa, as the diplomatic capital of Africa, we saw an opportunity to build and avail the high-end diplomatic-spec residencies to the embassies, international organizations in Ethiopia and power Addis with what it takes to maintain its capital city status of Africa – high end diplomatic residency.

Greg: GREA’s business strategy is to develop properties that will be tenanted by blue chip multinational corporations who have the ability to enter into US dollar denominated long-term lease contracts. The opportunity to partner with Verdant on this project was therefore aligned with our strategy.

Capital: what is your process of demand research and project development?

Greg: From GREA’s perspective, the fundamentals of a property development are driven by the ability to secure a hard currency revenue stream, the quality of the tenants, having the right partner, and finally having comfort with a range of considerations around the country where the development would take place. All these criteria were met prior to GREA investing in Ethiopia.

Tim: For Verdant Ventures, in countries such as Ethiopia where the foreign secondary market for real estate is in a growth phase, we rely on a crossover between in-country specialists as well as generic regional knowledge and our experience on a pan-African basis. For DH1, as mentioned earlier, the main motivations were our in-country presence coupled with a key tenant demand – we pride ourselves on providing real estate solutions for our clients across Africa.

Capital: Now tell us about the project you have just completed in Addis, Elevation Residences. What is unique about the project:

Tim: Elevation Residences is a 112-unit, 7-storey residential tower developed to the highest international standards with two basements, 147 parking bays, autonomy of service systems for continuity of power and water during any unforeseen breaks in supply as well as meeting the seismic safety requirements of the United States Government for Ethiopia.

As the clientele are diplomats, particular attention is paid to comfortable living, high fire life safety systems as well as recreational facilities including a community room and lounge area, rooftop bar, children’s play area, heated swimming pool and gymnasium.

The 15 000sqm project represents foreign direct investment of over US$35 million and is supported by local banking institutions with a total project value of over US$55 million. At the peak of construction, over 800 Ethiopians were employed on site with a secondary employment generation of over 2500 jobs. With regard to sensitivity to local communities, we have been actively participating in corporate social responsibility works and have strengthened community relations since 2018. Initiatives are mainly focused on creating job opportunities to the local community, provision of on-the-job training, the refurbishment of communal infrastructure within the node, including drainage systems and road and streetlight upgrades, the beautification of surroundings and supporting the local youth in start-up businesses.

Capital: Is the project completed? When is it going to be inaugurated?

Greg: Yes, the project is now fully completed and ready to welcome our first tenants. We will be cutting the ribbon and inaugurating the site in August.

Capital: This is your first project in Ethiopia. What is your future plan in Ethiopia?

Greg: As a pan-African real estate group, we are keen to provide turn-key projects like Elevation Residences especially where the need is greater. We just started with 112 units and we are aware the need is much higher, especially so with international companies continuing to send their expat teams to Addis as the economy continues to open up.

Tim: So, yes, we would like to replicate our initial success and build more properties here in Ethiopia provided we have the continued support of the Ethiopian Government and Addis Ababa City Administration. We are a private company with fiduciary responsibility to our shareholders and we need to ensure that the economics of each our projects are right. We will continue to explore the market and build more properties in the years to come.

Capital: What kind of support or incentives is required for you to build more properties in Ethiopia?

Tim: We invest based on equations, incentives and foreign exchange regulations enacted at the time of investment, with good faith and firm belief that any regulatory change will not be applied retrospectively and adversely affect the project’s return on investment. We are therefore keen to engage with the respective stakeholders to sort out some investment hiccups we have encountered, including investment incentives, forex directives and VAT implications so that explicitly agreed incentives and forex management agreements at the time of investment are maintained through the project life, in order for us to have confidence to build more properties here in Ethiopia.

Greg: We are very grateful for the extraordinary welcome and support we were accorded by the Ethiopian Investment Commission that is our first stop as an FDI-registered company. We are also very grateful for the strong support we have received from the Government, as well as the Addis Ababa City Administration who have assisted with permits and approvals.

by the Ethiopian Investment Commission that is our first stop as an FDI-registered company. We are also very grateful for the strong support we have received from the Government, as well as the Addis Ababa City Administration who have assisted with permits and approvals.

For a project the size of Elevation Residences, with over US$50 million of investment so far, we need clarity, consistency and predictability of investment incentives, foreign exchange regulations and related policy changes. Availability of hard currency for purchase of import items remains a challenge and we would appreciate the support of the banking sector together with the central bank to minimize the negative effect this has on project delivery and investor confidence.

Capital: What regulatory changes are affecting you severely and what are you doing about this?

Greg: One particular concern we have is the recently issued Amended forex Retention Directive by National Bank of Ethiopia, that has effectively reduced the forex retention from 70% to 31.5% of total inward remittance. This is a huge blow to our operation given we have raised significant amount of dollar debt capital for the project and the project economics were made on the existing forex retention regulation of the land when we launched our project in 2018.

This new directive is now being applied retrospectively, severely impacting on our debt-servicing ability. Furthermore, most of our tenants are embassies in Ethiopia who are paying their rental payment in dollar but their payment is automatically converted to Birr given classification of in-country dollar payments as non-remittance items. We are aware of several international companies in industrial parks having raised similar concern and the Ethiopian Investment Commission is in discussions with the Foreign Affairs and Trade ministries to find possible solutions. We will be engaging the EIC, the Ministry of Finance and the National Bank to secure policy dispensation from the adverse effects of the new directive and enable us operate within the agreed investment incentives, including the forex retention policies that were agreed at the time of our investment.

Capital: What do you envision to achieve from your engagements with the Government?

Tim: As explained before, Addis is the political capital of Africa and Ethiopia has made impressive strides in infrastructure to maintain Addis’ competitiveness including road and transportation, climate resilient urban planning, internet and mobile service expansion and recently impressive mega beautifying projects across the capital.

While Ethiopia’s place as the only non-colonized African country as well as her spearheading of pan-African struggles in the past has solidified Addis’ role as a political capital of Africa, future global cities’ choices and decisions will be based on infrastructures, livability, conducive environment and availability of high-end diplomatic residencies and related facilities. Addis is contending with emerging cities like Accra, that took home the AcFTCA headquarters and Kigali, that took home AU’s African e-trade Group headquarters. Future-proof developments which include international standard residencies are part and parcel of the infrastructure needed to maintain Addis’ status of Africa’s diplomatic capital.

Greg: We are incredibly happy to have contributed towards that goal by building our first 112 units for the use of US &and other diplomatic corps as well as international corporates as tenants. We would appreciate maximum support from the Government to help us maintain investment incentives, and grant us special dispensations where warranted, so we can continue to build more properties here in Ethiopia.

Capital: Any final word you would like to say ahead of the inauguration of your project this month?

Tim: As foreign investors who have the ability to shift focus across a number of African countries based on their ease of doing business, we have been attracted to the clear vision and growth trajectory in Ethiopia and are certain that there will be renewed focus on attracting companies such as ourselves to invest further in the country by providing fiscal policy certainty to our existing and future developments.

Foundational crisis

To those seriously interested in the whole spectrum of human affairs, (not excluding our interaction with ‘Mother Nature’) the current systemic/structural crises have become truly frightening. Unsafe imbalances tend to dominate the operations of the various global institutions. Many of the interactions in the various sectors of collective human existence; politics, economics, etc., are not only superficial and fake, but are also precariously fragile. The economic domain of the world order, which anchors all other institutions, (more or less) is unstable. The slightest perturbation within this dominant sector is bound to cause major disruptions across the world. Unfortunately and like before, (the 2008 financial crisis, etc.) the global sheeple (human mass) is intentionally misled about the prevailing concrete reality. Instead of facts and the bitter truth, the sheeple is fed lies, lies and statistics. Frivolous news and numbing entertainment are aggressively used to detract the global masses from important issues!

As we never tire of repeating, the global economy, which is fixated on continuous growth, is an epitome of stupidity. Further exasperating the situation brought about by this nonsense is the monetary system that underpins the global economic regime. Whichever way one cuts it, modern finance is built on massive fraud and it is this fraudulent activity that is accelerating the demise of the world system! Like many things in life, the current crises of modern finance emanate from internal as well as external challenges. The continuous printing of money out of thin air has distorted the very rule of the game. Those connected to the money spigot become immensely rich, (way beyond compensatory rewards for their efforts), while the working stiffs continue to lose ground. The lopsided income distribution, particularly since the 2008 financial crisis, is a very clear example of what finance is capable of doing. If truth be told, modern finance has single handedly redefined what capitalism is all about.. Understandably, the Davos crowd is now very worried. These operators know that the whole scheme is a scam, and without this con game most of their supposed wealth (unearned) will just vanish into thin air, whence it came! At the end of the day, real wealth is derived, directly or indirectly, from the systemic disfranchising of the global sheeple’s labor. The Davos bunches are masters at cleverly employing various manipulative technics to have their ways. Wrongly educating the masses as well as their minions to unquestioningly accept the status quo, hence their own subjugation is one such scheme.

The other agenda item in the Davos jamboree is how to save global finance from ascending informatics. The onslaught brought about by modern informatics in finance, particularly in the area of currency is scaring bankers and the central banking system. The two evils existing banking/financial system depend on, namely; hierarchical centralization and non-transparency, are being challenged by the emerging crypto currencies! All cryptos, almost without exception, (exceptions are those being concocted by the banksters/states) are working to get rid of these two evils of the prevailing global financial regime. Again, this moves is scaring the daylight out of the manipulative cliques, at the service of monopoly capital. Naturally many of the global states are genuinely confused about cryptos and where they are heading. On one hand, those who have not been profiting immensely from the current arrangement (peripheral countries) want financial regime change. On the other hand, the core countries want to maintain their hold of the system to that they can continue to milk the poor in their countries as well as abroad. What would ultimately prevail in the long run is anybody’s guess. To be sure, there are many problems and difficulties associated with cryptos that need to be solved before cryptos become fully useable. Some states are meticulously working to come up with cryptos that will help change the existing fraudulent banking system!

In the mean time the global sheeple is becoming angrier by the day, hence ‘populism.’ If things don’t improve significantly and soon, what follows might well be interactions involving pitchforks, guillotines and machetes! In fact, one of the major agenda item in Davos is how to deal with the rising ‘populism’ worldwide. Davosians have figured out that ‘populism’ will pose serious challenges to their ongoing accumulation process. ‘Populism’, whether of the right or left inclination, might not tolerate the current polarized existence. Various initiatives to seriously undermine the reigning economic regime is already underway by forward articulators and activists. Alarming resource shortages and visible environmental degradation cannot inspire long term confidence in the system, however much one is brainwashed. The ‘knowledgeable’ elites, particularly those who have major stakes in the global status quo, have chosen to be part of the problem instead of trying to become part of the solution. Sadly, the large majority of the learned is sufficiently brainwashed by establishment institutions, (including the paid and state media) to be of much help in devising needed alternatives.

Ethiopia earns $3.6 billion in revenue from export

Ethiopia has earned 3.6 billion US dollars from export of different commodities during the concluded 2020/2021 fiscal year, the Trade and Industry Ministry announced.

In the past budget year, the country earned 592 million US dollars more, showing over 19 percent increase from revenue registered in the same period of the previous year.

Ethiopia’s export mainly depends on agricultural products with coffee and flower contributing 25 and 13 percent respectively to the total export value.

He also underscored the need to shift to manufacturing, which is contributing only 6.8 percent to GDP.

Agriculture, manufacturing and mines contributed 2.47 billion (68%), 390 million (11%) and 668 million USD (18%) respectively to the total earning. 93 Million USD (3%) is earned from export of electricity and electronics materials.

From the total export Coffee earned 25%, Gold 19%, Flower 13%, Khat 11%, Oil seeds 9% and grains account for 6% with a total value of 3 billion USD.