National Oil Company /NOC/ announces international bid for the construction of the first coal washing plant in Ethiopia in Benishangul region.

The company has invited interested companies for the supply of full set of coal washing plant. Thus suppliers with competitive prices who can manufacture and supply the complete coal washing plant with latest technology, are invited to for the bid. According to the bid document the winning company will be given an Engineering, Procurement and Construction /EPC/ contract.

This is a standard term that refers to a special form of project execution and contract design for the coal washing plant, in this case, the company will be expected to do the construction from designing with in a given time and budget and also the supply and put on the machineries, training of staffs with the standards that the completed project is required to meet.

On June 17, 2021, the foundation stone of for the coal refining and enrichment plant has been laid in Assosa, Benishangul Gumuz State. The total cost of the project is expected to be about one billion birr whereas according to officials from the company that Capital obtained, the government has promised to provide 70 percent of the cost with long term loan, hence the rest 30 percent will be covered by the company itself. Beside, providing loan as the source told Capital that the company has been promised to get foreign currency without any waiting time to purchase all machineries needed to the plant.

The plant is expected to be completed in 11 months, and will have a capacity to produce 1 billion tons of coal annually. Moreover, it targets to cover 100 percent of the local demand.

“Quality of local coal is low which the industry direly needs, and perhaps our company will build a coal washing factory with high quality standard and affordable price,” the firm explained.

Ethiopia uses coal in its cement and textile factories by preserving heat at times of power interruption and to Coal production at the national level will help to recover costs incurred in foreign currency expenditure on the mineral beyond encouraging investors to the energy sector, according to Ministry of Mines and Petroleum.

The government has been taking various measures to encourage investments in coal. Amending the energy proclamation and licensing potential companies who wish to invest in the sector are some of the measures that Ethiopia has taken in mining industry.

According to the Geological Survey of Ethiopia, there are 17 main locations in which potential coal resources have been identified which amounts to over 360 million tons of coal.

On the contrary, the country spends up to 200 million dollars annually importing coal for use in cement production and energy generation.

The bid is expected to be open on August 19, 2021. NOC has been engaged on importing coal for the last five years.

NOC announces bid for first coal washing plant

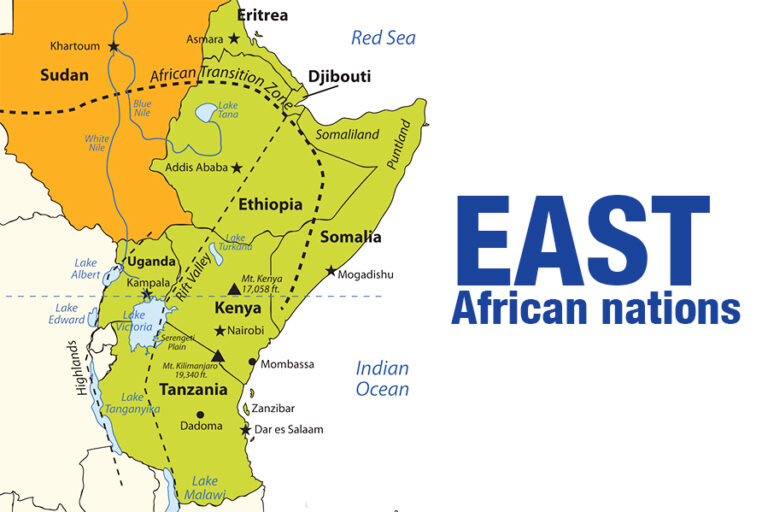

East Africa to bounce back to positive recovery, experts hint

Despite economic challenges associated with the COVID-19 pandemic, many East African countries are projected to see positive growth during the recovery process this coming year, according to Smollan.

East African nations are in better condition going into the recovery process, as most have a diversified economy and non-reliance on exports of commodities, according to analyst Judd Murigi from ICEA LION Asset Management.

“How governments and the private sector respond to the impact of the pandemic over the coming months will determine the mid- and long-term success of the region’s efforts at building back better,” said Hardeep Sound, SAP, East Africa.

According to a Deloitte East Africa Economic Impact Report, countries such as Kenya and Ethiopia which had slower GDP growth last year will see positive growth rates this year. East Africa is one of the fastest growing regions on the continent, and has more potential for acceleration.

Ethiopia specifically has promising growth potential, being the second most populous nation in Africa. One obstacle other than its closed economy is the unreliability of supply chains in a landlocked country with relatively poor infrastructure. Additionally, many consumer goods are imported, and the birr is weakening, making inflation a significant concern.

Other countries within East Africa are experiencing similar effects. Kenya, according to Fanuzi, is on the verge of moving from a low-income nation to a middle-class consumer economy. In Uganda, many business owners and retail supply chains were disrupted, impacting the majority of the population that relies on daily wages. Rwanda, after implementing one of the strictest lockdown policies in the continent, is expected to grow by 5.1%.

During the pandemic, much like other nations, East African countries experienced a positive impact on online retailers, brick and mortar markets being severely impacted, increased demand for cleaning products and food supplies, and rising unemployment.

Thunes link with Dashen to ease cross border payments

Thunes, a global payment network, is partnering with Dashen Bank to open a quicker and cheaper option for sending money to Ethiopia from around the globe.

The cross-border payment solution opens the option for people around the world to send money directly into one’s bank account or Amole mobile wallet.

“This technology-powered solution gives Dashen Bank’s customers fast and convenient access to overseas funds,” said Dashen Bank CEO Asfaw Alemu. “It’s another positive step towards our goal of transforming Ethiopia’s financial services sector and delivering innovations to serve our customer’s needs better.”

Before this option, international money transfers were slow and unreliable, harming Ethiopian businesses and much of the nation which relies on payments from family overseas.

The program is expected to boost financial activity in Ethiopia from overseas and increase the circulation of foreign currency into the nation’s economy, as Thunes’ network of sending partners encompasses more than 100 countries.

“We are delighted to partner with Dashen Bank, one of Ethiopia’s leading banks,” said Andrew Stewart, Global Head of Networks at Thunes, adding, “Thunes continues to invest in and grow our network in the world’s fastest growing economies. Our global partners can now give their customers enhanced access to this important corridor in Africa with faster and more convenient transfers.”

Purpose Black officially launches share sell

Purpose Black Ethiopia, which is a dynamic business established to offer an economic solution with an end-to-end product-to-consumer, officially started selling its shares following its launch ceremony which was held on Saturday July 24, 2021 with the attendance of different government officials, founders and guests.

Purpose Black was founded with a goal of helping black farmers to produce globally competitive products and get fair prices for their products, and has also aims of reducing youth unemployment, promoting diaspora investment, selling products at a fair price and stabilizing the consumer market by promotion of export and increase of foreign currency earnings. Furthermore, it is keen on facilitating agricultural technology transfer.

“As the name indicates, the goal of Purpose Black is to offer economic solutions to some of the major problems of the black people all over the world, and through digital economy it will create a fruitful and thriving economy and thus the first model for the implementation of the global initiative of purpose black is purpose black Ethiopia,” said Fisseha Eshetu /MD/ founder of the platform.

As he explains, the first target is to mobilize capital and to this end, the platform is planning to raise about ten billion birr in capital through three ways; selling share locally, mobilizing the diaspora, and through propose black Africa which is targets to collect ten billion dollar to distribute all over the continent of which Ethiopia will benefit through the same.

As stated the company will sell shares through the 17 banks, financial institutions and telebirr which is also is one of the options alongside CBE birr and other digital wallets. Those who are abroad can get the share through a credit card from Abyssinia bank and commercial bank of Ethiopia. Similarly, depositing in swift accounts or money transfer platforms using the commercial bank are ways of purchasing the shares. For those who do not have bank access, they can get the share in Ethiopian embassies.

The company has prepared 10 billion shares which each is worth 100 birr and the minimum share one can buy is 10 shares worth 1000 birr. Also they are required to pay only 25 percent of the payment which is 250 birr and the rest can be paid in 2 years’ time interval. This of course is made in a way that makes the system accessible for all.

“Since it is working on an end-to-end service starting from the farmer system it is not fully dependent on technology or e-commerce. The technology in the middle is a system to make it successful,” explained Fisseha, adding, “We are trying to bring both the retail and hybrid ecommerce, so the distribution will be through the ecommerce and retail channels. To realize this, we will build five hyper markets in Addis Ababa, ten supermarkets and 1000 retail stores which will be all over the country. For those who can get access to the internet, they can use the ecommerce, whereas the others can use the retail channels, and thus it’s dynamic in this regard.”