The International Monetary Fund (IMF) Executive Board has completed the second review of Ethiopia’s Extended Credit Facility (ECF), enabling the country to access approximately $248 million to support its balance of payments needs. This decision marks a significant milestone in Ethiopia’s economic reform journey, following the ECF’s approval in July 2024 as part of a broader $10.7 billion support package from development partners and creditors.

The ECF arrangement, totaling SDR 2.556 billion (about $3.4 billion), aims to bolster Ethiopia’s Homegrown Economic Reform Agenda (HGER) by addressing macroeconomic imbalances and laying the groundwork for private sector-led growth. With this latest disbursement, total funds released under the ECF now amount to approximately $1.611 billion.

Ethiopian authorities have demonstrated a strong commitment to achieving the objectives of the Fund-supported program, with all quantitative performance criteria met during this review period. However, the government’s contributions to targeted social safety nets were lower than anticipated due to necessary preparations for expanding these programs amid an increased budgetary envelope.

The IMF noted improvements in the functioning of the foreign exchange market, attributing this progress to significant policy actions taken by Ethiopian authorities to enhance market efficiency. The National Bank of Ethiopia (NBE) has maintained tight monetary conditions while advancing modernization efforts within its monetary policy framework.

Despite these advancements, challenges remain. The government is working diligently to restore debt sustainability and secure a comprehensive debt treatment under the G20 Common Framework. The ongoing negotiations with official creditors are seen as crucial for achieving long-term fiscal stability.

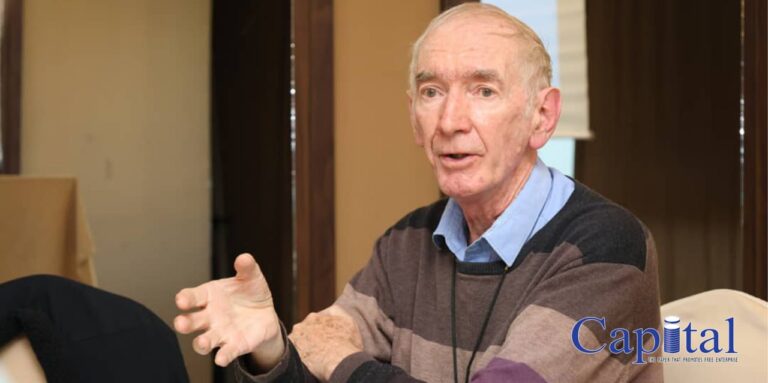

Following the Executive Board discussion, Nigel Clarke, Deputy Managing Director of the IMF, commended Ethiopia’s progress in implementing its Fund-supported program and addressing macroeconomic challenges. He highlighted that the transition to a flexible exchange rate has advanced significantly, contributing to a stabilization of the parallel market premium.

Clarke emphasized that maintaining prudent macroeconomic policies, including tight monetary policy and avoiding monetary financing of government deficits, is essential for reducing imbalances and ensuring overall economic stability. He also urged the Ethiopian authorities to expedite efforts to expand targeted social safety nets to protect vulnerable households.