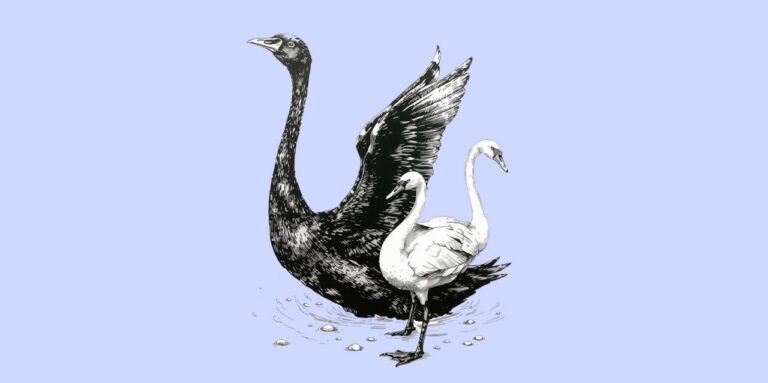

Taleb’s “black swan” describes rare, high-impact events that are only rationalized after the fact-financial crashes, pandemics, or geopolitical upheavals. He famously argued that our models and institutions are ill-prepared for such shocks, lulled into complacency by the illusion that the future will look like the past. Yet, as Taleb himself notes, not every disaster is a true black swan. The COVID-19 pandemic, for example, was long anticipated by epidemiologists, even if ignored by policymakers. The same logic applies to many crises in the Horn of Africa: droughts, famines, and conflicts are often painted as unpredictable, but in reality, they are the product of long-standing structural vulnerabilities.

In the Horn, the real black swan is not the occurrence of crisis, but the rare emergence of genuine, transformative peace or prosperity. The region’s history is a litany of “inevitable” disasters-civil wars, coups, and humanitarian emergencies-each rationalized as unforeseeable, yet rooted in decades of poor governance, exclusion, and underdevelopment. The lesson? The true danger lies not in the unpredictable, but in our persistent failure to address the obvious.

If black swans are about surprise, white elephants are about waste. The term, with roots in Southeast Asian tradition, refers to assets or projects that are expensive to maintain but deliver little value-think empty stadiums, unused airports, or ghost cities. In China, 90 million vacant housing units and entire ghost cities stand as testaments to malinvestment. In the United States, millions of empty homes and commercial properties accumulate value on paper, but serve no real purpose.

The Horn of Africa is not immune to the white elephant syndrome. Across the region, grand infrastructure projects-often funded by foreign loans or aid-dot the landscape, their promise of development unfulfilled. Nairobi’s skyline is punctuated by gleaming towers, many of which remain half-empty. Roads, ports, and industrial parks are built in anticipation of growth that never materializes, while basic services like health and education languish. These projects are not just economic missteps; they are political statements, monuments to a development model that prizes visibility over viability.

The drivers are familiar: the lure of easy capital in a global fiat system, the pressure to emulate the “masters of the world system,” and the absence of genuine local policy autonomy. The result is a cycle of debt, dependency, and disillusionment, in which the region’s scarce resources are squandered on projects that serve the interests of a few, rather than the needs of the many.

If black swans are the unpredictable and white elephants the wasteful, white swans represent the routine-the events and outcomes we expect, and therefore ignore. In the Horn of Africa, the persistence of poverty, inequality, and instability is a white swan: entirely predictable, yet no less tragic for its inevitability. Decades of underinvestment in human capital, weak financial sectors, and poor infrastructure have locked the region into a low-growth trap.

Despite periodic bursts of GDP growth-Ethiopia, for example, has been among the world’s fastest-growing economies-the benefits have been uneven, and the underlying vulnerabilities remain. The region’s economies are still dominated by subsistence agriculture and low-end services, with little genuine structural transformation. The lack of democratic governance and inclusive institutions further compounds these challenges, fueling cycles of conflict and fragility.

Comparing the Horn of Africa to the global north or east, the metaphors of black swans and white elephants take on a sharper edge. In the West and China, the problem is often one of excess-too much capital chasing too few productive opportunities, leading to asset bubbles and white elephants. In the Horn, the challenge is more basic: mobilizing enough resources to meet fundamental needs, while avoiding the trap of flashy but useless projects.

Yet, the region is not without hope. Recent years have seen some progress: economic growth rates have improved, especially in Ethiopia and Djibouti, and there is a growing recognition of the need for more inclusive, accountable governance. The key is to learn from the mistakes of others-eschewing the pursuit of white elephants in favor of investments that build resilience, foster innovation, and deliver tangible benefits to ordinary people.

The metaphors of black swans and white elephants are more than academic curiosities; they are warnings. For the Horn of Africa, the path forward lies not in chasing the latest global fads or erecting monuments to ambition, but in confronting the region’s white swans: the predictable, persistent challenges that have held it back for decades. By focusing on the basics-education, health, infrastructure, and inclusive governance-the region can avoid the twin perils of surprise and waste, and finally realize its vast potential.