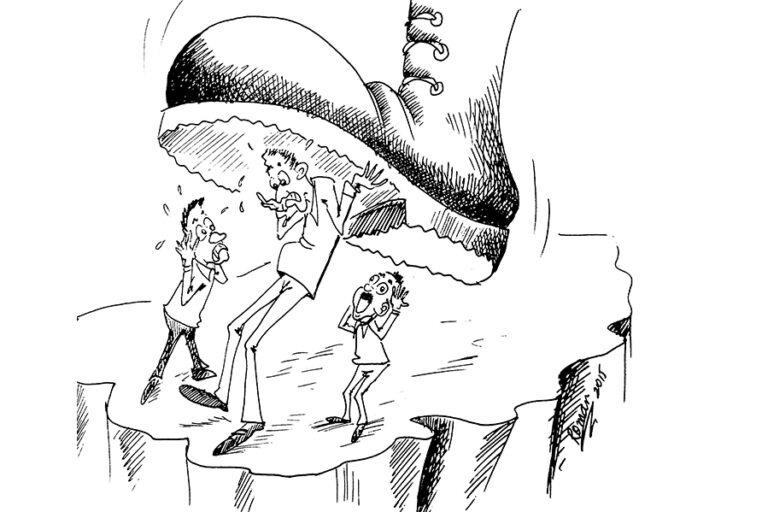

It seems a number of countries are quite capable of surviving sanctions. Some of them not only survive sanctions but also tend to strengthen their overall domestic capacities. By and large, it is the smaller nations of the world system that disproportionately suffer from sanctions imposed on them by the powerful. Eritrea is one example. The larger countries of the world that operate under sanctions can potentially use this forced regime as an impetus to develop local capacity in various sectors. Sanction can also increase the resilience of a society. Importantly, the whole scheme of sanctions highlights the precarious and unpredictable nature of the reigning modern world order! We will look at four countries that are more than surviving sanctions!

The Iranian state has been under sanctions of one sort or another for a long time. This oil rich nation, not only managed to survive, but also accomplished its main objective of becoming an advanced military power. For example, Iran’s indigenously built missile technology is quite sophisticated. The country has developed long-range missile systems that can reach its potential adversaries, namely Saudi Arabia and Israel. This weapon system seems to have deterred provocation. Its naval power is also not to be underestimated. Sanction might have retarded the realization of potentials in other sectors of the economy, but it has not done much to make the country a military weakling, the very opposite of what the sanction imposers had in mind. The Islamic Republic of Iran doesn’t seem to like the whole idea of nuclear weaponry. Its nuclear weapons program was already in the process of being phased out when the west started probing the issue. Sanction or not, the Iranian tech sector is much more advanced compared to its nemesis, Saudi Arabia.

By the same token North Korea also seems to have achieved its main objective, the development of nuclear weaponry. North Korea is now a recognized nuclear power with a working ICBM (Inter Continental Ballistic Missile). Again, the sanction imposers’ main desire of halting its nuclear program has failed. No doubt, sanctions have caused some difficulties, both to the government as well as the citizenry. Practically sandwiched between China and Russia, the Korean peninsula is a very strategic region. Any major conflict there is bound to involve these two superpowers, most likely fighting on the same side, against outside adversaries. One has to study the history of the 1950s Korean war to appreciate the determination of the North Koreans to come up with meaningful deterrent (WMD) against real and potential adversaries!

Venezuela seems rather unprepared to the sanctions imposed on it by the powerful. Its oil revenue, on which it relies for most of its foreign exchange earnings, has dwindled significantly. The powerful nations also want ‘regime change’ in Venezuela. In this regard, the proven ‘color revolution’ might well be used as one options to dislodge the government in power! Amongst the sanctions, the unavailability of financial facilitation by western bankers is one. This imposition has led the Venezuelan government to develop a cryptocurrency backed by its oil and gold. The project is to help loosen the grip of western bankers that is creating havoc to Venezuela’s trade and investment. Like Iran, Venezuela is determined to sell most of its oil in other currencies, besides the dollar. It is also bartering its oil for goods/services with potential allies, like China! The ramification of using cryptocurrencies in the trading of essential commodities will be massive, to say the least. This scheme has a potential to derail the dominance of fictitious currencies in world trade!

Russia is probably the one country that has benefitted immensely from sanctions imposed on it by the west. Russia is now the number one wheat exporting country in the world. The systemic delinking of its fossil fuel’s sales from the mighty dollar has also undermined the dollar’s reserve status. Today China and Russia, the number one buyer and seller of fossil fuel respectively, are using their own currencies for the transactions! This is very significant as it creates less demand for the dollar in the world, thereby making it difficult to issue debts (US Treasury bills) without qualm! In the sphere of technology, Russia has always been amongst the leaders, particularly when it comes to military hard wares. Since the sanctions, Russia’s weapons sales have skyrocketed. Some of the new military gadgets that can destroy missiles, (like the US cruise missiles) are being sold to friendly nations, whose numbers are increasing by the day! In the words of the US general, ‘… an increase in Russian surface-to-air missile systems in the region threatens our access and ability to dominate the airspace,’ Votel, Commander of the US Central Command.

Both Russia and China, are working to become independent of the SWIFT system (electronic international financial transactions, dominated by the west). Locally developed scheme are in the offing in both countries. Moreover, the BRICS, which include Russia and China, have embarked on the project of developing an alternative Internet system! All in all, sanctions don’t seem to work.

SANCTION STRENGTHENS?

Serving the community

Corporate social responsibility (CSR) is not going to solve the world’s problems. Meanwhile in the modern world the concept catch economic players and replaces companies’ commercials or advertisement by investment on social contribution. That said, CSR is a way for companies to benefit themselves while also benefiting society.

Globally institutions carry-out what is commonly known as CSR through the provision of various benefits to surrounding communities and the public. They seem to understand providing such benefits and promoting those efforts to the larger public is as good as advertising their products and services since it increases their acceptance in the public eye.

Companies, particularly in other countries, carry out CSR through the provision of various benefits to the surrounding communities and the public in general. This culture is also adopted by local companies where efforts are being made to responsibly dedicate their resources to the community. It has become common to observe schools, roads, and water pipeline built by local as well as international companies.

Though not as one expects, institutions in Ethiopia are also performing social functions, but with a number of problems. Companies are not seen employing strategic or long term plans. Instead, they rely on short term plan leading to investments in inappropriate projects. Practitioners also have little know-how on how to conduct CSR functions.

Even though the growing private sector in Ethiopia is now understanding the concept and playing big role to improve the living standard of the general public in different approaches particularly in direct and indirect donation and support. However their role does not get adequate recognition due to several reasons including lack of communication and know how.

One of them is Sisay Shekour, an investor engaged in different businesses including an industry Apex plc, a pioneer and the only environmentally friendly pencil factory in Ethiopia.

However Sisay’s environmentally friendly pencil factory, Dot Pencil, creates significant job opportunity mainly for women, his company role did not get the required attention. Capital talked to Sisay about his factory and its other activities in the area, Gelan, 28km south east of Addis Ababa in Oromia region. Excerpts;

Capital: Let us start from the factory?

Sisay: The company that started as a climate friendly manufacturing industry about 17 years ago at Gelan, an industry town. As far as my knowledge we are the only pencil factory in the country. Currently from the total of 180 employees, 97 percent are women.

Capital: Your company is stated as environmentally friendly, what does it mean?

Sisay: Our pencil factory is also a pioneer by introducing unique pencil product that is well accepted by customers. What it makes environmentally friendly is that we are not using forest products for our production; rather our major input is waste papers and used newspapers than using the traditional stick to make pencil. On this scheme youths in different part of the country are collecting used papers and wastes that they supply for us for recycling on the pencil production process. Really we are very satisfied for our contribution to keep environment and not contributing for deforestation. Besides that it has also created several jobs for others, who collect the papers and sell to our factory.

Capital: During our visit to the industry town of Gelan we have learnt that you are involved on CSR, can you explain it?

Sisay: Currently Gelan is one of the major industry hubs in the country. When we started our factory about two decades ago we are one of the two or three private businesses in the area and the town was also very small. When we commence activities we learnt that there are some social challenges like lack of jobs for women and they go very far to fetch water from a pond. Other wise to get safe tap water they have to go back to Akaki or go up to Bishoftu town, which is very far and need extra expense that is unaffordable for the society. So we decided to share their burden by providing job for women and supplying clean water for the society for free.

Capital: When and how do you start the water supply and how does it operate?

Sisay: We drilled 207 meter deep water well that produces 3 liter per second by hiring an Indian contractor. It started 17 years ago and the water production capacity is the same through all these period. We are pumping the water throughout the day, while it is very expensive due to the power interruption which is frequent and that forced us to use diesel generator to continue the supply without interruption. For this service we have different costs like the expense for regular maintenance and permanent employees to look after for the service all the time.

Capital: Who use the water and how?

Sisay: It is available at the gate of the factory, which is located on the main road from Addis Ababa to Bishoftu. So without interruption anyone can fetch water 24 hours a day. Residents, hotels and other businesses or any institution or others who want to get the water can fetch from the facility. Even farmers from the surrounding rural area come with their donkey cart to access the safe water. For instance youths are fetching the water to sell it to businesses around the town. It means that it has become a source of income for the community in the town besides drink.

Capital: Why do you do this and what is your principle for CSR?

Sisay: I feel that I have to share my opportunity for others who need it. I myself have been contributing several supports in different locations and in different social projects. For instance I was engaged in different social works like school development in Gurage zone and other areas, providing different regular support for different communities, constructing different social service centers and this will continue. Creating jobs for young women or sharing their burden by providing water nearby may not big contribution but it creates a satisfaction for me and it is also my responsibility as part of the society.

Capital: Do you get recognition for these initiatives?

Sisay: The biggest recognition we get and that we are satisfied is the feedback of the community, who are really a family of the factory. Secondly as a pioneer we have become a lesson for other industries to engage on CSR in the area. While we received different recognition certificate from the local government and the town and zonal administrations have good feedback for our activity.

Capital: Regarding CSR what is your future plan?

Sisay: There are rural communities in the surroundings of Gelan town that are fetching water from our facility. Now we have a plan to work tirelessly to drill more wells in that surrounding and make it easy for our community in the rural area to access the safe drinking water. We also have different initiative in different forms for the specific area and other places.

Ethiopia’s digital payment gateway

The first ever three years National Digital Payments Strategy (NDPS) of National Bank of Ethiopia (NBE) hints that it would apply incentives and discouraging instruments like tax incentive and cash handling fee to attain the goal of the NDPS.

The strategy that officially launched on July 15 and will face implementation till 2024 quoted Prime Minister Abiy Ahmed’s message that there are efforts within and beyond the Ethiopian payment ecosystem that have laid the foundations for digital payments in Ethiopia, “however, challenges still remain and a strategic effort to address these is needed; a NDPS.”

“I trust that NDPS will assist Ethiopia in meeting the challenges that currently lie ahead as we transform the payment ecosystem to move toward a cashLite and more financially inclusive economy,” Abiy said on his message on the new strategy.

The NDPS strategy that developed by the support of partners like United Nations’ Better than Cash Alliance amplified the requirements of encouraging and the discouraging tools to obtain the expected dream on the way to transform digitization payments in Ethiopia.

“Incentives are often an important way to support the business case to drive change in different industries and topics. Countering the cost of cash through fees is a critical component of championing the adoption of digital payments,” it said on its strategic pillar 2.

It elaborated the benefit stating it creates a cost incentive for the financial system players to invest in the development and expansion of the digital offer, and over time pass along the incentives to the consumers to opt for digital transactions instead of cash.

Tax credit incentive, cash handling fee or limit cash transaction are the benefits or vice versa.

For instance it said that revenue authorities can incentivize merchants to accept digital payments by offering them tax credits and by the overall reduction in operational costs for the companies, “in other geographies, tax credits are further being used to encourage the creation of digital payment platforms for commercial banks and for innovators. Looking at the global adoption of digital payment systems, incentives can be identified as a key propagator.”

Cash handling fee

Regarding cash handling fee it hinted that instruments that will discourage financial firms to manage cash handlings.

“In Ethiopia’s financial sector, the cost of cash transactions is not formalized. The NBE does not charge financial institutions a fee for cash-handling services like dropping off and picking up banknotes. Financial institutions do not apply differentiated fees for cash transactions to their customers,” the NDPS explained.

“Furthermore, transactions done at bank branches are free, while transactions completed through digital platforms (ATMs) have a cost. The current landscape includes most merchants accepting only cash and encouraging consumers to go to banks to withdraw cash to use for everyday expenditures,” it added what the current status seems.

Due to that it said that introducing fee on cash handling would change the circumstance.

“The implementation of cash-handling fees by central bank for financial institutions can contribute to financial institutions feeling the full cost of cash and reacting by reducing cash acceptance and encouraging customers to use digital instruments,” the strategic document stated.

As outcome it said that over time, financial institutions pass along this cost to users through differentiated pricing structures for different payment channels, making digital transactions a more cost-efficient method of payment, “this also creates an additional revenue stream for central bank and for financial institutions in the long term.”

According to the intention of the strategy document, the establishment of a new charging instrument also expects banks to expand creativity and focus to attain the digital payment scheme.

“Establishing a contextualized cash-handling fee structure for financial institutions will create an important incentive for key players to develop and expand digital payment offerings in Ethiopia. Implementing this action will require a transition plan to facilitate the move from significant cash dependency to a cashLite economy,” it explained.

As a recommendation of implementation it stated that all cash-handling services provided to the banks and other financial institutions be mapped with a defined timeline to gradually introduce fees for cash-handling services for financial institutions, in line with global good practices.

Limits on cash transactions

Imposing limits on cash transactions is also the other instrument which targets core area of boosting digital payment of the country.

The strategic document shows that NBE is conducting internal analysis to impose limits on cash transactions, identifying as key challenges the lack of availability of access points (POS) and the resistance of informal merchants to move to digital due to tax implications. It added that further studies required implying effective instrument to limit the cash transaction.

Coordination with EthSwitch and financial institutions, define a contextualized limit for cash transactions in line with global good practices, and define a timeline to implement limits for cash transactions have stated as recommendation to introduce the scheme.

Tax incentives & e-receipts

The strategic document stated that merchants currently argue that they have little incentive to conduct digital payments, “today, merchants that accept digital payments have multiple POS machines due to the lack of interoperability. Consumers are not incentivized to leverage digital payments, since most merchants do not accept them.”

It said creating incentives will increase the adoption of digital payments, while creation of tax incentives for electronically traceable payments can encourage adoption while decreasing the shadow economy.

As a recommendation it stated in coordination with the Ministry of Revenue (MoR), to determine tax incentives to propose to merchants (including VAT rebates on purchases, tax credit eligibility).

The timeline for implementation of tax incentives, cash handling fee and limited cash transaction would be in the third year of the strategy period.

The other key area that will take place in related with the launching of NDPS is developing a law to make legalize electronic receipts (e-receipts) on the eye of MoR.

In Ethiopia, e-receipts are not accepted as a proof of payment for tax purposes. “There is an initiative currently in place to create legislation that will accept e-receipts to increase the adoption of digital payments,” it said.

In coordination with the MoR, prepare guidelines, processes, and forms to accept e-receipts as a proof of payment will be done in the way to make the country one of the digitize nations.

The legislation to accept e-receipts as proof of payment will be implemented starting from the late first year of the strategy period that means this budget year up to early of next budget year.

Foreign investors

About the opening up of the digital payment sector for foreign investors, the strategy stated that additional studies shall be developed on the stated period of implementation period. But it did not indicate or show time frame when it will be opened.

“The NBE and the Ministry of Finance (MoF) have plans to review the existing directive to define a strategic way forward where partially or fully foreign-owned public or private enterprises may be licensed as payment instrument issuers,” it said.

It added that revising regulations will be considered in the medium term to allow foreignowned companies to participate in these services.

It also stated that in coordination with the MoF and the Ethiopian Communication Authority, adaptation and revision of the directive should be done to meet market requirements, and potential expansion of electronic money services to foreign-owned companies.

ESLSE strategizes to lift containers from congested Chinese ports

The Ethiopian Shipping and Logistics Services Enterprise (ESLSE) announced that it is working to manage the containerized consignment challenges under short and mid term plans. Half a billion birr worth of new containers have been procured.

It said that most of the staked containers at China will be eased by the third week of August.

It had stated that the world does not have enough containers in the right places to handle cargo demand which also imposes pressure on Ethiopian coming cargos.

The logistics giant that is in challenges on the global phenomenon of cargo boxes shortage stated that meanwhile the problem is still not easing on ESLSE, it has enabled to ship 150,000 containerized cargos in the 2020/21 budget year that ended on July 7. The plan was to handle 170,000 boxed cargos in the period.

In relation with the global pandemic, COVID 19, economic slowdown had engulfed the logistics sector. Moreover, containers being stranded in different destination globally fueled to the fire as it created shortage for operators including ESLSE. Similarly container freight rates price spiked by triple.

Spikes of consignment fleets from China to the US and northern Europe following the slowdown of the pandemic was stated as fueling the situation further more.

According to ESLSE, the season mainly July and August is the peak period for global trade that has also impacted the circumstance.

On its announcement the sole multimodal operators, ESLSE disclosed that in connection with the stated challenges boxes including Ethiopian clients have stayed at different Chinese ports for long that affects customers business.

It said at least 13,000 empty boxes should be required for transporting Ethiopian cargos that is stacked in China ports.

ESLSE has now designed a short and medium terms solution to move the cargos within the coming six weeks.

Roba Megersa, CEO of ESLSE, says that his enterprise has negotiated with CMA-CGM and MSC, French and an Italian-Swiss international shipping lines respectively, to clear container backlogs located in China, “the deal includes moving new bookings.”

He told Capital that ESLSE has also repositioned its four vessels to ports in China for fleeting at least 1,000 containers each on a single voyage. “We have made available containers on leasing and procurement arrangement to ease the delay consignment,” he added.

On the other hand, ESLSE is also working to lift the cargos located on South East Asia ports mainly in Thailand and Indonesia via leased spaces on other operators.

“Commodities like edible oil, handbook and other holiday goods will be transported on this arrangement before the end of August. On these strategies we would enable to move totally 15,000 containerized cargos in the stated period,” Roba explained.

New boxes

ESLSE is currently looking to buy more boxes to solve the challenge that is expected tom be prolonged for more years on the mid term strategy.

According to the CEO, chaos in global shortage of shipping container may continue in the coming two years, “Shipping companies will also continue on procuring new boxes since existed containers are not timely positioned.”

“Accessing empty containers from logistics market has become very strange,” he added by explaining that it makes the container freight rate to skyrocket.

He said that for instance the spot market for the fleeting of 40 feet container from China to Europe is now USD 20, 000. However the price of freight spikes and the demand for cargo has never shown reduction.

He justified that because of the continuing cargo demand that is not supported by making available the existed empty containers shipping line would need more boxes that will be filled by procured containers.

“On this spot market rate it could be difficult for the Red Sea to compete with others,” he added.

On the current spot market shipping companies are charging USD 11,000 per container for consignment to the Red Sea from China. “If we buy containers and at the same time transport cargos to our destination it would make us profitable. At the same time, we shall have additional containers,” Roba says, adding, “when it is also compared with the current rates of leasing space on other companies; transporting cargos with our new containers would make us profitable, due to that we are working to buy more containers.”

Under the revised strategy, ESLSE has targeted to own 10,000 containers, “if our boxes are increased we shall assign our vessels to lift cargos that would be congested in different ports.”

He revealed that at least ESLSE may have more voyages on ports to China when the number of owned containers increased like what it is doing now.

Weeks ago the logistics giant has procured 1,000 twenty foot equivalent units (TEUs) and 2,000 forty feet containers on swift approach following the failure of frequent attempt to buy the box for the past over a year on formal bidding processes.

The new procurement expands the number of ESLSE’s owned containers almost to double.

Before the latest, adding ESLSE had about 2,940 containers with two common sizes of TEU or forty feet; of which 2,398 TEUs, 184 forty feet high cube (HCs) and 358 forty feet general purpose (GPs) containers.

Wondimu Dembu, Deputy CEO for Corporate Service at ESLSE, said that as per the feasibility assessment the current swift procurement has been conducted to mitigate the chaos and accelerate the operation and profitability besides owning additional boxes.

“As per the feasibility assessment the procurement cost will be fully covered with a single containerized cargo shipment from the place where new boxes are available to Djibouti,” he told Capital.

“According to our evaluation, rather than using leased containers on the current rate buying and making operational owned containers shall make more profit. Due to that we have taken the fast decision,” the Deputy CEO for Corporate Service elaborated.

He said that from the short listed suppliers’ one of the top three containers manufacturers in the world CXIC Group Containers Co., Ltd of Changzhou based Chinese firm is selected to supply 3,000 containers within a month time. When the deal was sealed 72 TEUs have been already produced, while the company has a capacity to produce one boxes per 90 minutes. “Some of the boxes are getting in to the operation and others will follow the path,” Wondimu added.

China is popular on its container and vessel industry and most of the container manufacturers are located on major port areas like Shenzhen, which is one of the main ports that Ethiopian cargos are lifted.

Different reports indicated that Chinese companies currently top the list of the biggest shipping container manufacturers. They take up 85 percent of the world’s total production of shipping containers.

For the procurement of the stated amount of containers ESLSE has allocated almost half a billion birr.

Wondimu said that the enterprise has also floated a fresh tender to buy another 3,000 containers on the way to attain its previous plan.

“The latest bidding process is for the continuation of failed bid that was on the way for a year time,” he explained.

This time around ESLSE has targeted to buy additional 1,120 TEU and 1,880 forty feet containers.