The International Air Transport Association (IATA) now forecasts airlines will lose $314 billion in passenger revenue this year amid the coronavirus outbreak, a deepening of $62 billion from its previous projection.

The new forecast equates to carriers’ 2020 passenger revenue being down 55% on 2019’s figure, and reflects worsening economic forecasts and predictions that the return to air travel is likely to be slower than previously expected.

The lower revenue in the new forecast is based on a projected 48% fall in traffic measured in RPKs for the full year, IATA states.

“We have never seen a downturn this deep before,” says IATA director general Alexandre de Juniac. ”In our latest scenario, full-year passenger revenues plummet 55% compared to 2019, while traffic falls 48%. In other words, half our business disappears. That’s catastrophic.”

IATA’s previous forecast – released on 24 March – predicted a $252 billion, or 44%, hit to passenger revenues and a 38% reduction in RPKs.

Most regions will see full-year RPKs down by around 50% year on year, IATA now predicts, with the North American sector being the outlier at around 36%.

The Asia-Pacific region accounts for $113 billion of the lost passenger revenue, followed by Europe with $89 billion and North America with $64 billion.

The airline body’s revision of its 2020 revenue projection was partly prompted by a steeper-than-expected reduction in worldwide flights leading into the second quarter, which IATA expects to be the height of the crisis. It had earlier forecast a fall in flights of around 65% year on year at that point, but by early April flights were down 80%, with the industry being “virtually grounded” aside from domestic markets in the USA and Asia.

Among its other revised considerations are a worsening economic outlook, including a projection that global GDP will fall by nearly 6% this year – twice as large as the contraction seen during the global financial crisis.

Amid that economic pressure, IATA expects the restart of travel in the second half of 2020 to be slower than previously forecast, driven in part by a slow return to international flights.

Domestic markets are forecast to return ahead of international markets, but will still be dampened by poorer-than-expected economic conditions.

IATA notes that while domestic markets accounted for 58% of passenger numbers in 2019, international flights accounted for 67% of traffic measured in RPKs – reflecting the latter’s importance to airlines.

The recession alone would push global RPKs down 8% in the third quarter, IATA notes, before travel restrictions and the confidence effects of the coronavirus outbreak are considered.

Even amid a recovery in traffic beginning in the third quarter, global RPKs are still predicted to be down 33% in the fourth quarter of this year.

IATA also notes that its revised assessment reflects a much deeper impact on markets in Africa and South America than previously expected.

Its forecast continues to be based on severe domestic travel restrictions lasting for the three months that make up 2020’s second quarter, with some curbs on international travel extending beyond that period.

IATA deepens projected airline revenue loss to $314 billion

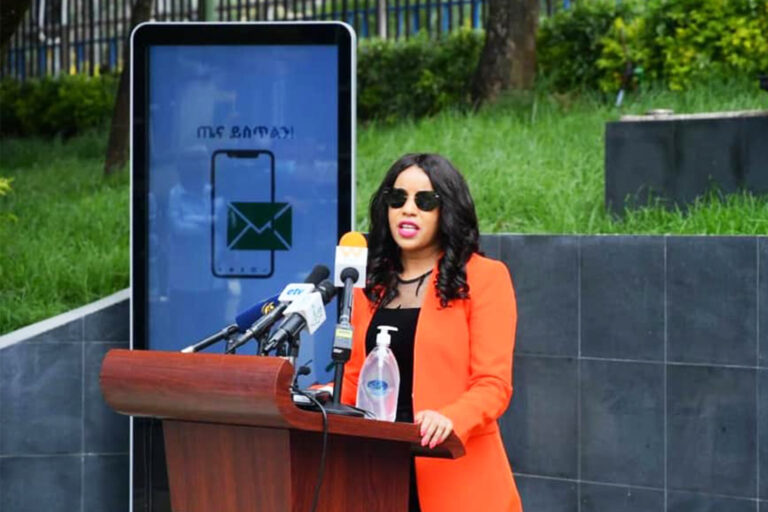

Ethio-telecom has announced plans to improve its services beginning from tomorrow, April 16, 2020.

Firehiwot Tamiru, CEO of Ethio-telecom, said the service improvement aims to limit the movement of people outside of their home and stem the spread of coronavirus (COVID-19).

According to her, the company will avail ‘Stay at Home Mobile Package’, ‘Stay Connected,’ and ‘Stay Active’ services as of tomorrow.

‘Stay at Home Mobile Package’ allows subscribers to make 30 minutes voice call locally for five birr, together with 20 free local text messages.

It also offers subscribers 100Mb internet service for five birr and 250Mb internet service for 10 birr, along-with 20 free local text messages.

‘Stay Connected’ services offers subscribers 300Mb internet service and 30 minutes local voice call for 15 birr, with 20 free local text messages , she said.

All the services will be available from 6am in the morning to 4pm in the afternoon.

The state owned telecom provider also announced a donation of 100 million birr in support of the country’s effort to prevent the spread of corona virus (COVID-19) pandemic.

“The organization will continue discharging its social responsibility” said the CEO.

African farmers face difficult times ahead amidst COVID-19, locust swarm

Millions of farmers across Africa are facing economic devastation as COVID-19 pandemic disrupts exports and global food supply chains according to the Impact of Coronavirus on Africa’s Agriculture April 2020 report released by Selina Wamucii that gives a most-recent and ground-up perspective on how the pandemic is affecting African farmers.

According to John Oroko, CEO of Selina Wamucii, intra-Africa trade is around 2% while exports from Africa to the rest of the world range from 80% to 90% of total exports, of which a huge share is made up of agricultural produce.

“The COVID-19 pandemic has unfortunately come at a time when our farmers depend largely on exports to markets outside the continent and also before the commencement of trading under the African Continental Free Trade Area (AfCFTA) that was scheduled to commence on July 1, 2020, thereby creating a single continental market of more than 1.3 billion people. Now, unlike no other time, we can see a demonstration of why the success of the African Continental Free Trade Area will be directly linked to securing the livelihoods of African farmers in the future,” says Oroko. “COVID–19 is severely disrupting trade in key markets for Africa’s agricultural produce and African farmers are bound to experience a nightmare in export market access,” adds Oroko.

African farmers are a relatively elderly demographic and 70% of Africa’s food is currently produced by women, who are also primary caregivers across many of Africa’s rural regions. This means therefore that a key segment of the farmers in the region is also at a higher risk of contracting COVID–19. Morocco tops the list of African countries whose agricultural exports face the highest risk largely due to the country’s over-reliance on the European market given its close proximity and well-established traditional trading ties.

In 2018, Morocco’s FFV, fish, seafood and cut flowers, worth $3 billion was exported to the European Union, translating into over 78% of the FFV, fish, seafood and cut flowers worth $3,846,083 exported by Morocco to the rest of the world in that year.

Kenya’s agricultural exports also face a great risk mainly due to the over-reliance on fresh-cut flower exports, the bulk of which end up in the European Union. Additionally, over 50% of Kenya’s FFV exports and nuts go to the European Union and China, which are markets that have already been shaken up. In 2018, Kenya’s FFV and nut’ exports worth $223,113,000, out of the total $482,559,000 exported, went to European markets. Before the COVID–19 pandemic, farmers in Kenya and other East Africa countries were already suffering severe locust invasion and now COVID–19 has worsened the situation.

The U.N. Food and Agriculture Organization (FAO) has warned that a new wave of locust swarms are starting to form, representing an unprecedented threat to farmer livelihoods – specifically in Kenya, Ethiopia, and Somalia. As a result, farmers are facing a double catastrophe from the impact of COVID–19 and the locusts at the same time, a combination that will negatively affect their farm yields.

Habesha Steel donates over 50 million birr for coronavirus fight

Habesha Steel Mills Plc responded to the government’s call for the support to mitigate the effects of corona virus in Ethiopia.

The Indian firm announced a donation of 50 million birr worth of medical supplies including oxygen to health facilities to help the fight against the pandemic.

According to Kishen Raval, Managing Director of Habesha steel, this is the time we stand together. “The factory will produce the products in its own factory which is located around Dukem, Oromia region,” Raval told Capital.

Starting form the announcement of the first case in Ethiopia the government has been calling individuals and companies to support its resource mobilization in the effort to coordinate the gathering of financial and non-financial materials for COVID-19 emergency preparedness.

Besides giving the medical supplies, the factory is planning to support around 500 people that are living around its factory at a time of a lock down. “We are planning to give them fully prepared hot meal because if we give them the materials there will be a lot of people who don’t have the other ingredients to prepare the food,” said the managing director.

The factory is also well known by its developmental works in the surrounding community. It built 106 houses for displaced Ethiopian citizens, delivered a constant fresh water supply to Taddecha village in Dukem. It also provides the cost of education for many children every year and regularly donates food, clothes, blankets etc to the less fortunate in the area.

“We have built road and speed breakers for municipal school due to the many accidents whilst children were walking to school; we also helped the police force by building police guard posts at different areas,” the managing director told Capital.

Habesha Steel has more than 1500 employees and “we have built the modest customer oriented company and have shown a steady growth due to its focus on quality and modern system of production, this is because of our strong committed and loyal employees from the community, so we have to help each other at such times” said Kishen Raval.

“We want to be a role model for other industries, our collective and concerted efforts to help one another in times of great need will be the only way we overcome this difficult times,” added the managing director.

One of the largest steel factories in Ethiopia Habesha Steel produce full range of reinforcement bars for construction of residential and commercial structures, flyovers, bridges, and power plants.