Bunna Bank has announced a remarkable milestone, with its total assets surpassing 54.53 billion birr, reflecting an increase of 8.14 billion birr in the current fiscal year. This achievement comes as the bank held its 15th Annual General Meeting of Shareholders, where it also reported a pre-tax profit of 930.1 million birr for the year.

Founded 15 years ago, Bunna Bank has grown to serve over 14,000 shareholders and employs more than 4,100 permanent staff across its 474 branches nationwide. The bank’s paid-up capital also saw a significant rise, growing by 549.2 million birr to reach a total of 4.83 billion birr.

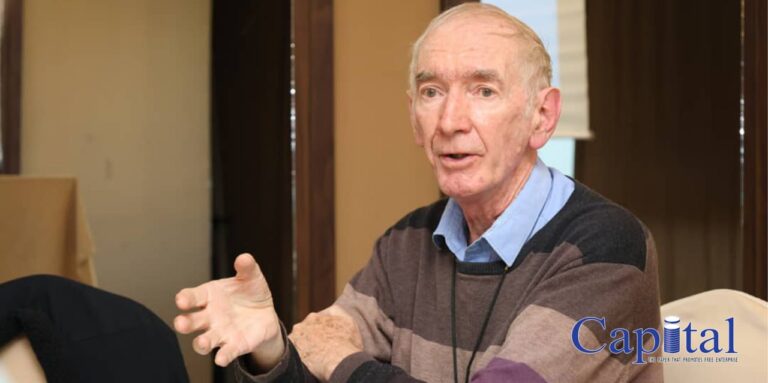

During the meeting, Ambassador Alemayehu Sewagen, Chairperson of the Board of Directors, presented the bank’s annual report and highlighted the various challenges facing Ethiopia’s banking sector. High inflation rates, foreign exchange shortages, and overlapping regulatory guidelines have posed significant obstacles to financial institutions. Despite these issues affecting loan distribution and deposit collection, Bunna Bank has managed to maintain its profitability and competitive edge.

The bank mobilized a total of 43.87 billion birr in deposits during the fiscal year, marking a 20% increase from the previous year. The breakdown of deposits included 2.79 billion birr from savings accounts, 1.55 billion birr from demand deposits, and 2.62 billion birr from time deposits.

In terms of service expansion, Bunna Bank reported that it installed 200 cash payment machines at various locations including branches, hotels, and commercial service points during the fiscal year. The number of card banking users increased to 413,892, with transactions totaling 1.39 billion birr processed through these machines.

Ambassador Alemayehu emphasized the bank’s commitment to enhancing digital banking services and resource mobilization as part of its strategic focus moving forward. The bank provided loans amounting to 4.1 billion birr across various sectors of the economy, increasing its total lending volume by 11.8% to reach 38.87 billion birr.

However, Bunna Bank faced challenges in foreign exchange earnings due to a decline in exports and remittances from abroad, which totaled $167.6 million for the year ending June 30, 2024.

The bank’s leadership is also implementing a comprehensive risk management program in line with the National Bank of Ethiopia’s standards and has approved a five-year corporate strategic plan for 2023-2027 aimed at further strengthening its operations.