As Ethiopia’s capital market takes shape, we are witnessing great enthusiasm from banks, insurance companies, and corporates eager to explore new financing and investment frontiers. ESX is today pleased to receive increasing listing applications, including those from major financial institutions. We anticipate that, before the end of the current fiscal year, the significant majority of financial institutions will be listed. Meanwhile, one of the most frequent questions I hear, however, is: “Why should we list on the ESX main or growth market if our shares can trade on the Over the Counter (OTC)/unlisted market?”

This question often comes from a place of caution, understandable for institutions that have managed shareholder registers for decades. Yet, as we move toward a modern, transparent, and well-regulated market, it’s important to clarify what the Ethiopian Securities Exchange’s listed or OTC market means – and what it is not.

Let me debunk a few common myths.

Myth 1: Listing will prevent companies from offering shares to existing shareholders

It will not! Under Ethiopia’s Commercial Code, all companies, whether listed or unlisted, retain the right to grant pre-emptive rights to their shareholders during primary follow-on offerings. Listing does not take away this right. Rather, the prospect of being listed, or enhanced price discovery on the listed market, improves investor enthusiasm and expedites the capital raise process.

Myth 2: Listing is cumbersome

Listing is no more complex than being traded on the OTC market. In fact, all public offers, whether for listing or OTC trading, go through identical registration requirements with the Ethiopian Capital Market Authority (ECMA), in line with the Capital Market Proclamation and relevant directives. At ESX, our listing requirements, included on ESX Rulebook, are simple and practical. While it is common for exchanges in other developed markets to have a significantly higher baseline for listing, on top of the mandatory registration and public disclosure requirements, ESX Rulebook has set the baseline to the minimum possible. This is done of course, by being conscious of the Ethiopian realities but also the global trend where regulators and exchanges are increasingly removing cumbersome and unnecessary requirements to incentivize companies to come to public markets. The past few years alone, US, EU, UK, Singapore, Hong Kong, Australia, Thailand, etc, regulators and exchanges have revised or are undertaking public consultations to minimize obligations of listed companies. As a new comer and learning from these trend, ESX’s basic listing requirements require aspiring companies to demonstrate: minimum paid-up capital (ETB 500 million for the main market and 50 million for the growth market), two to three years of trach record audited financial statements – with an at least one year profit record if the entity is intending to list on ESX main market, and a 10% – 15% free float – i.e. the proportion of shares held by public investors.

These are requirements most Ethiopian financial institutions already meet if not exceed by significant margin. If this conversation is being held in any developed or less developed markets, no serious financial institution would consider to remain trading on the OTC market, while it meets all the key listing requirements. No serious investor would compromise on the promise of higher liquidity, and as a result issuers will not hesitate to pick the most liquid venue to encourage investors to subscribe to their capital raise effort. Hence, that is why it is not so common to find OTC equity markets in many countries. Where they exist, they are meant for those that cannot qualify to meet the listing requirements, e.g. LSEGs AIM Market, US OTC Group markets (OTC QX, QB and Pink sheets) or are simply meant for delisted companies ( which will also be the case for Ethiopia). It simply does not make sense for a large financial institution that meets the listing conditions to trade alongside a much smaller a start-up, SME or delisted securities. In most markets, the choice of being listed and becoming a public company are almost synonymous. If a large institution would prefer not to be listed, it would also most likely remain private (i.e. closely held company among founders, etc.), rather than being a public company with thousands of shareholders.

Myth 3: Post-listing reporting obligations are too burdensome

Again, not true. ESX has adopted a streamlined and basic disclosure regime aligned with The Capital Market Proclamation and ECMA’s relevant directives, which are mandatory obligation on all publicly traded companies. In this regard, companies are basically required to: submit biannual financial statements and disclose any material information. These obligations are largely identical for companies whose securities are traded on the OTC market. In other words, the compliance burden is largely the same, but the benefits of listing (liquidity, status, visibility, and credibility) are far greater.

Myth 4: The OTC market allows trading through company offices or social media

This is a critical misunderstanding. Under the Capital Market Proclamation, all trading – whether on the main, growth, or OTC market, must take place through licensed intermediary, and all securities must be dematerialized (i.e. be held in electronic form at the central depository). In short: trading outside regulated exchange or OTC platforms – including share register offices or social media “markets” is prohibited.

Myth 5: OTC trading allows investors to choose who to sell to in the secondary market

In line with ESX Rulebook, both the listed and OTC markets are multilateral and anonymous. Sellers and buyers do not know each other; and ESX state of the art trading system, will automatically match orders to ensure fairness and transparency. The idea that OTC markets allow “direct” or “selective” trading is simply a holdover from the informal, pre-exchange era. It goes without saying, while ESX has certain market segments and exceptions where negotiated trading arrangements are allowed, these are not intended for the trading of securities where there are multiple buyers and sellers of the same, often, liquid security.

Myth 6: Listing requires additional effort

Every company making a public offer – whether planning to list or trade on the OTC platform – must, among others, engage a transaction advisor, external auditor, appoint an independent legal advisor, and must register its securities with ECMA. Once the company has gone through this process, the listing process is, in fact, straightforward: the company (or its transaction advisor) submits a draft prospectus and supporting materials to ESX, ESX reviews and grants an approval in principle. In essence, the registration process and the approval in principle process are undertaken simultaneously. Following this, the company finalizes and publishes the prospectus and, if raising capital, completes the subscription process, after which ESX grants final listing approval, and the security is listed. That’s it – a simple and efficient process designed to help companies access capital and grow.

While listing indeed requires paying additional listing fees, which is modest compared to most other expenses the company incurs to become public, the same cost is compensated by lower trading fees on the listed market, while the OTC market has higher transaction fees for shareholders. In essence, shareholders pay higher transaction fees and potentially encounter lower liquidity if the institution trades on the OTC market.

Finally, Why Listing Matters

Companies, especially large financial institutions, should see listing on ESX’s main or growth market as more than a regulatory exercise – it’s a strategic investment in credibility, liquidity, and investor trust. Listing represents the pinnacle of building a great company – the shared aspiration of every visionary CEO, committed Board, and dedicated shareholder. Listed institutions benefit from better access to capital, improved valuation in the secondary market, enhanced transparency, and corporate reputation – all essential as our financial sector becomes more competitive and integrated with regional and global markets.

This effort must be viewed within the broader context of the profound changes taking place in Ethiopia’s financial sector. The appetite among financial institutions to strengthen their capital base – and their potential to do so in the short to medium run – has never been greater. Over the past three years alone, we have witnessed financial institutions announcing capital-raising initiatives that, collectively, could more than double the sector’s total subscribed capital within the next two to three years. To put this in perspective, it took the same financial institutions more than three decades to reach the current capital levels – and they now aim to replicate that growth in just a few years. This unprecedented momentum is driven by a combination of factors: the ongoing liberalization of the financial sector, growing investor awareness, and expanding investment opportunities both domestically and regionally.

As this transformation unfolds, financial institutions must recognize that their shareholders will increasingly scrutinize not only returns, but also liquidity and perception when making investment decisions. Crucially, large financial institutions need to understand that investors – for the first time – will begin to value capital gains alongside dividends, a concept that has long been missing from Ethiopia’s investment lexicon.

For too long, investors have been unable to realize capital gains due to the absence of an efficient secondary market. This is precisely what the ESX is addressing. By providing a transparent, well-regulated, and liquid marketplace, ESX will enable investors to benefit from both dividend income and capital appreciation. This, in turn, will strengthen the ability of financial institutions and other corporates to raise capital efficiently and at lower cost.

If investors begin to see stronger returns and capital gains in alternative asset classes, the ability of companies to attract equity investment will weaken. By fostering transparency, liquidity, and investor confidence, ESX aims to ensure that the securities market remains the most attractive and sustainable avenue for long-term investment – to the benefit of financial institutions and the economy as a whole. Our goal at ESX is to build a fair, efficient, and inclusive capital market. We are proud that both our main and OTC markets operate under clear, investor-protective rules. But as we look ahead, we encourage Ethiopia’s leading financial institutions and other companies to take the next logical step: listing on the Exchange. By doing so, you will not only unlock growth for your own shareholders but also strengthen Ethiopia’s capital market as a whole.

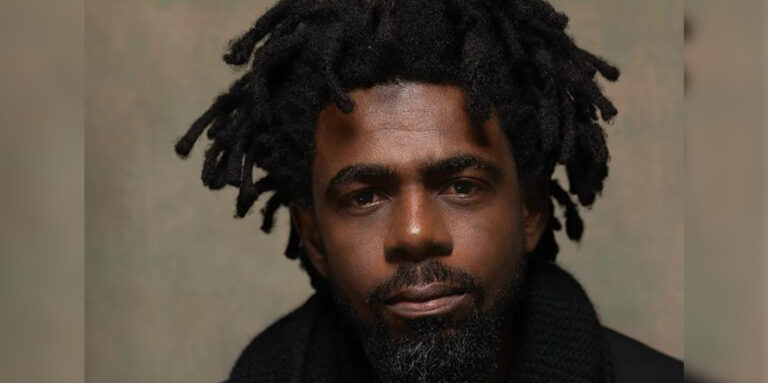

Tilahun Esmael Kassahun (Ph.D.) is the Chief Executive Officer of the Ethiopian Securities Exchange (ESX), Ethiopia’s first organized securities exchange established to facilitate transparent trading of equities, bonds, and other financial instruments.